Conflict Over Payroll Tax Deferral Plays Out at House Hearing – Alexis Gravely, Tax Notes($). “Democratic lawmakers expressed concern at the September 24 Ways and Means Social Security Subcommittee hearing — titled “Save Our Social Security Now” — that the president’s repeated promise to permanently cut the payroll tax if he’s reelected would endanger the future of the program.”

Treasury: Trump's payroll tax deferral won't hurt Social Security – Naomi Jagoda, The Hill.

"We do not expect deferral to impact the Social Security Trust Funds because the deferral is temporary and all deferred taxes must be repaid," a Treasury spokesperson said in a statement.

The spokesperson added that "the deferral will have no impact whatsoever on current or future payments received by Social Security recipients, and the Trump Administration remains fully committed to the integrity of the Social Security Trust Funds."

Stimulus Update: House Democrats Considering New, Smaller Relief Package - Sergei Klebnikov, Forbes. “House Democrats are likely to release a smaller coronavirus relief package sometime next week if they don’t agree to a deal with Republicans before then, according to multiple reports confirmed by House Speaker Nancy Pelosi on Thursday.”

New Jersey Lawmakers Pass Budget With Heftier Millionaires Tax – Kate King, WSJ($).

“Democratic Gov. Phil Murphy has long pushed to increase taxes on millionaires, but it wasn’t until the coronavirus pandemic delivered a body blow to state revenue that the legislature’s top leaders, also Democrats, agreed. Under a bill passed Thursday, tax filers earning between $1 million and $5 million will pay 10.75% in income tax, up from 8.97%, on earned income above $1 million. All income above $5 million is already taxed at the higher rate.”

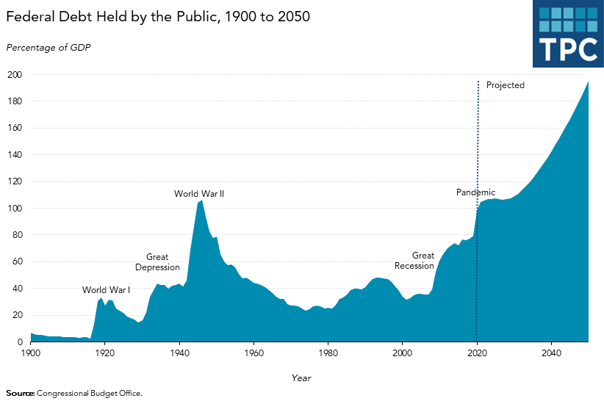

CBO Forecasts The National Debt Will Be Twice The Size Of The Economy. Watch Out For Higher Taxes – Howard Gleckman, Tax Vox.

“As a share of the Gross Domestic Product (GDP), the federal debt already is as high as it was at the peak of World War II. And CBO projects it will roughly double again by 2050. Even worse, its forecast assumes Congress won’t enact another large pandemic-related stimulus bill (it probably will), and that it will allow many of the tax cuts in the 2017 Tax Cuts and Jobs Act to expire on schedule in 2025 (it probably won’t).”

IRS Plans Opt-In Expansion Of IP PIN Program Beginning In 2021 – Kelly Pgillips Erb, Forbes. “Beginning in 2021, taxpayers may go to the Get an IP PIN tool on the IRS website, be authenticated, and immediately access a six-digit IP PIN. If you have a Social Security number (SSN) or Individual Tax Identification Number (ITIN), and you can verify your identity, you're eligible for the Opt-In program. To opt-in, you must use the online Get an IP PIN tool.”

IRS Provides E-Filing Relief Due to Software Outage - Tax Notes($). “The IRS has released a memorandum announcing that it will treat as timely filed a return and any elections filed with the return that were affected by the September 15, 2020, external tax return preparation software outage if the taxpayer successfully filed the return and any elections electronically by September 17, 2020.”

Dem Senators Call for Probe of IRS Warrantless Phone Surveillance – William Hoffman, Tax Notes($). “IRS officials confirmed in a call with Senate staff that the agency subscribed to a database provided by Venntel Inc. in 2017 and 2018 that provided information gathered from Americans’ cellphones, the senators’ letter says. The IRS used that information to track Americans’ location without a court order, according to the letter.”

Florida governor proposes college 'bill of rights' to party – WESH 2.

“Gov. Ron DeSantis thinks students who attend Florida’s 12 state universities should be able to socialize without worrying about getting thrown out of school.

DeSantis said Thursday he’s willing to consider a college students' “bill of rights” that would preclude state universities from taking actions against students who are enjoying themselves.”

Make a habit of sustained success.