IRS Update: 800,000 Taxpayers Tossed Stimulus Payments In The Trash – Bruce Brumberg, JD, Forbes.

“At a recent online meeting for tax professionals in the New England region, IRS staffers gave updates on IRS operations and, more significantly, on the Covid-19 Economic Impact Payments (stimulus checks) that the IRS issued to taxpayers. Remarkably, the IRS revealed that the agency recently sent about 800,000 notices to taxpayers who have not yet activated the stimulus-payment debit cards they were mailed. The IRS staffers on the call said this probably means many taxpayers accidentally “threw out the debit card thinking it was junk mail.”

The IRS “Dirty Dozen” - Tax Scams And Schemes – Jason B. Freeman, Forbes. “Every year, the IRS releases its so-called “Dirty Dozen”—a list of scams that target taxpayers. This year, perhaps as no surprise, the list emphasized schemes related to coronavirus tax relief, including Economic Impact Payments.”

Tax injured spouses to get catch-up COVID-19 payments – Kay Bell, Don’t Mess With Taxes. “The agency says that next month it will send catch-up Economic Impact Payments (EIPs) to about 50,000 individuals. These are the folks whose portion of the first round of coronavirus payments was diverted to pay their spouses' past-due child support. These catch-up payments will be mailed as U.S. Treasury checks to any filer who claimed injured spouse relief on their tax year 2019, or in some cases 2018, federal income tax filings.”

Investors Worried by Proposed Carbon Capture Regs – Kristen A. Parillo, Tax Notes ($). “Many tax equity investors will choose not to finance carbon capture projects if the credit recapture rules aren’t revised in the final section 45Q regulations, witnesses said at an IRS hearing.”

House Narrows Subpoena for Trump Tax Returns – Jad Chamseddine, Tax Notes ($). “Two House committees told a court that they have narrowed their subpoenas for the financial records of President Trump to comply with a recent Supreme Court ruling.”

“In a 7-2 opinion July 9, the Supreme Court sent Trump v. Mazars USA LLP back to the lower courts, holding that prior rulings in favor of the House committees didn’t consider all the possible separation of powers concerns. The Court created a new test for Congress and courts to abide by when seeking information from the president.

The letter said that Intelligence Committee Chair Adam B. Schiff, D-Calif., issued a memorandum narrowing the subpoena to key account holders and limited the date range by five years. Among the documents being sought by Schiff in the revised subpoena are tax returns and schedules that show any foreign sources of income or interests held in foreign business entities.”

White House Draws Doubt With Claim of $75 Billion for Poor Areas – Noah Buhayar, Bloomberg Tax ($). “Hours before the Republican National Convention kicked off this week, the White House had good news: Investors had plowed $75 billion into funds that target opportunity zones, showing the Trump administration’s signature tax break to help poor communities is working.”

Biden’s Proposal Would Shift the Distribution of Retirement Tax Benefits – Garrett Watson, Tax Policy Blog.

“Biden proposes converting the current deductibility of traditional retirement contributions into matching refundable tax credits for 401(k)s, individual retirement accounts (IRAs), and other types of traditional retirement vehicles, such as SIMPLE accounts. Biden’s proposal would eliminate deductible traditional contributions and instead provide a 26 percent refundable tax credit for each $1 contributed. The tax credit would be deposited into the taxpayer’s retirement account as a matching contribution. Existing contribution limits would remain, and Roth-style tax treatment would be unaffected.”

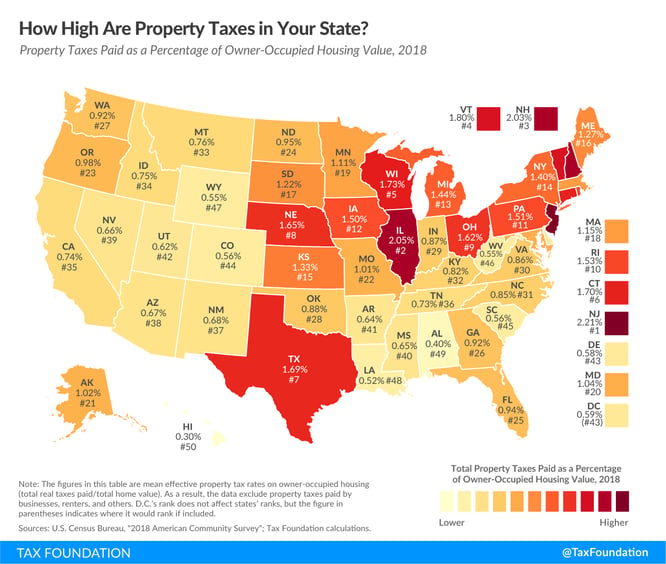

How High Are Property Taxes in Your State? – Janelle Cammenga, Tax Policy Blog. “Today’s map takes another look at property taxes, this time focusing on states’ effective tax rates on owner-occupied housing. This is the average amount of residential property taxes actually paid, expressed as a percentage of home value.”

Make a habit of sustained success.