GOP to Propose Aid Bill, With Extra Jobless Benefits Set to Expire – Rebecca Ballhaus and Andrew Duehren, WSJ($). “After days of disagreements between the White House and GOP lawmakers, Republicans are set to release their proposal for the next coronavirus relief bill on Monday, with millions of Americans on the verge of losing expanded unemployment benefits.”

“The Republican bill, estimated to cost about $1 trillion, will include another round of direct $1,200 payments to many Americans, $100 billion in aid to schools and universities and additional money for coronavirus testing, according to administration officials.”

Another Round Of $1,200 Stimulus Checks Coming, Trump Officials Say – Lisette Voytko, Forbes. “Top Trump administration officials said Sunday that Republicans are including another batch of stimulus checks in their proposal set to be unveiled this week, a revival of a popular element of the March rescue package, although the GOP is bent on reducing enhanced unemployment benefits, another favored benefit.”

House Republicans Turn to Credits in New Bills to Spur Growth – Alexis Gravely, Tax Notes ($). “Tax credits that promote medical manufacturing and innovative research are part of a new agenda for economic growth announced by House Republicans.”

GOP lawmakers on the House Ways and Means Committee released seven proposals July 23.

One of the seven introduced is Rep. Jackie Walorski’s proposal to double the Research tax credit. Taxpayers can currently elect either the traditional or the alternative simplified (ASC) method to compute their research credit. Rep. Walorski’s proposal would double the rates from 20% to 40% for the traditional method and 14% to 28% for the ASC method.

Many taxpayers are eligible for research and development tax credits. Eide Bailly's R&D specialists can help.

SBA Announces Tentative Plan to Begin Accepting Forgiveness Information from Lenders on August 10 – Ed Zollars, CPA, Current Federal Tax Developments.

The SBA Procedural Notice provides the following information about this new platform:

SBA has partnered with a financial services technology provider – Goldschmitt-CRI – to make available a secure SaaS platform (the PPP Forgiveness Platform) to accept loan forgiveness decisions, supporting documentation, and requests for forgiveness payments. The PPP Forgiveness Platform is available only to PPP Lenders, not PPP borrowers.

This platform makes available a user interface for Lenders to upload required data and documentation, monitor the status of the forgiveness request, and respond to SBA in case of an inquiry or if SBA selects the loan for review. SBA will post a link to the PPP Forgiveness Platform on its website. The PPP Forgiveness Platform will go live and begin accepting Lender submissions on August 10, 2020, subject to extension if any new legislative amendments to the forgiveness process necessitate changes to the system.

IRS Taxpayer Assistance Centers – with COVID precautions – are re-opening – Kay Bell, Don’t Mess With Taxes. “The usual TAC services soon will be available again nationwide, but be prepared for some process changes. Most TACs, even before the pandemic hit, already were operating on an appointment-only basis. Such planning is even more critical in this time of coronavirus.”

Per the IRS, social distancing of at least 6 feet and face masks will be required for in person visits.

IRS Illegally Seized Account Info, Crypto User Says - Kristen Parillo, Tax Notes ($). “A New Hampshire man has accused the IRS of illegally seizing his account information from three cryptocurrency exchanges via administrative summonses, but some tax practitioners are skeptical of his legal arguments.”

Solar Industry Wants Fix to Save California Property Tax Break – Laura Mahoney, Bloomberg Tax. “The solar energy industry in California, eager to hold on to a valuable tax break, wants to be carved out of a commercial property tax hike that voters will consider in November. Opponents say a proposed deal with lawmakers, however, is an unconstitutional bailout for special interests.”

Biden Tax Plan Could Undermine O-Zone Tax Benefit – Jonathan Curry, Tax Notes($). “Investors in Opportunity Zones may discover that the benefit of deferring capital gains taxes isn’t so great if presumptive Democratic presidential nominee Joe Biden gets his way.”

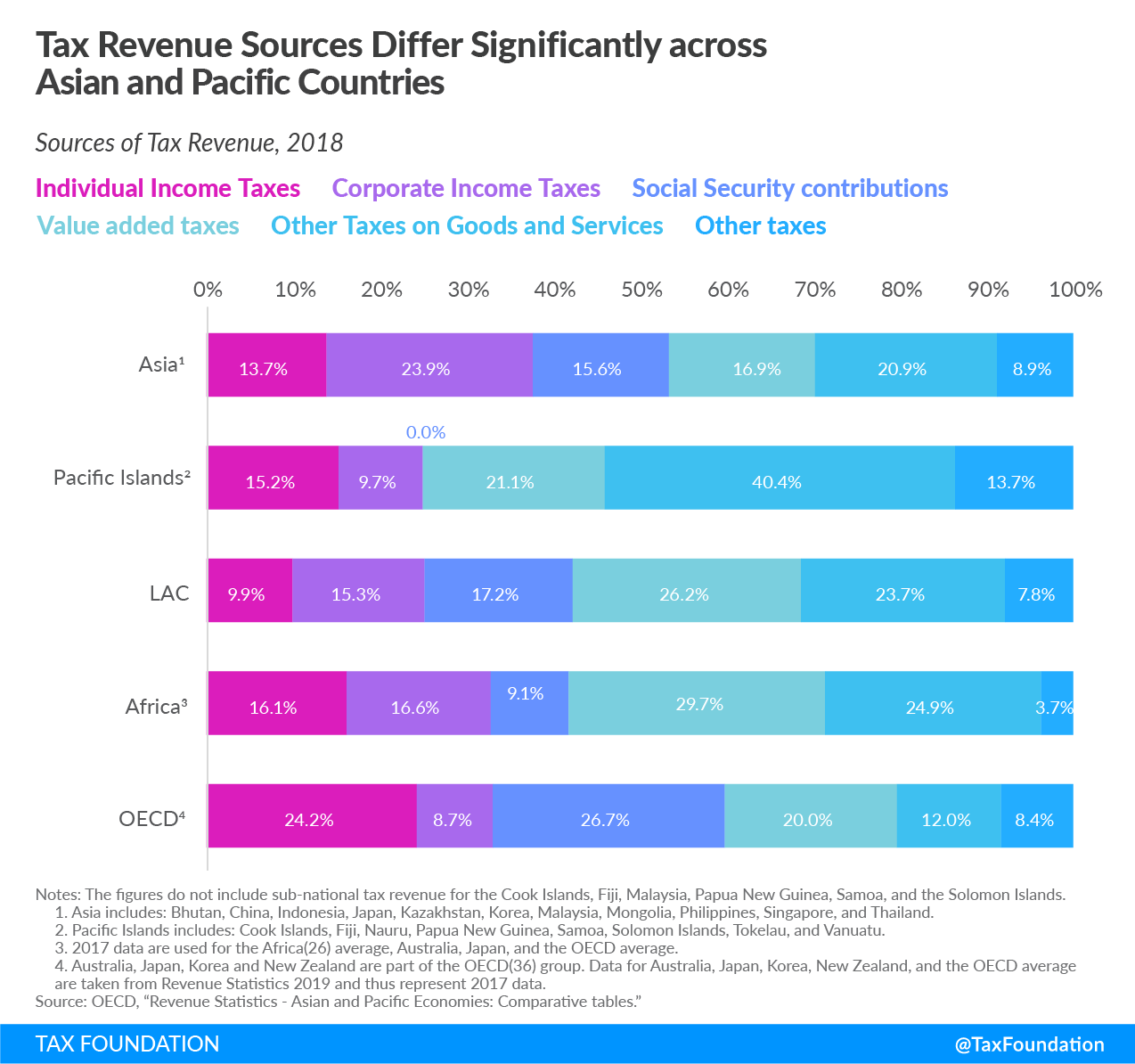

Revenue Gains in Asian and Pacific Countries Likely Offset by COVID-19 – Cristina Enache, Tax Policy Blog. “The Organization for Economic Co-operation and Development (OECD) recently published a report on tax revenue statistics in selected Asian and Pacific countries, covering 21 tax jurisdictions. The report provides tax revenue data from 1990 to 2018 and includes a section on nontax revenue data for selected Asian and Pacific economies. Additionally, a special feature co-authored by the Asian Development Bank (ADB) and the OECD explores the role of tax policy and administration during the COVID-19 crisis.”

“Because of the COVID-19 pandemic and the associated economic crisis, countries in the Asia-Pacific region will see a differentiated impact on their capacity of mobilizing domestic revenue depending on the structure of their economy. According to the OECD report, those economies that rely mostly on natural resources, tourism, and trade taxes are especially vulnerable.”

Make a habit of sustained success.