U.S. Companies Get Tax Reprieve in IRS Foreign-Income Rules - Richard Rubin, Wall Street Journal ($):

Lawmakers and companies say they thought the GILTI tax wouldn’t apply if companies paid rates above 13.125%. But there were technicalities in how the new U.S. system interacted with longstanding U.S. tax rules, which meant that many companies with relatively high foreign tax rates were subject to GILTI—including Kansas City Southern and Procter & Gamble Co.

The Treasury rules finalized on Monday largely mean that companies with tax rates above 18.9% shouldn’t owe GILTI.

This is retroactive; corporations who paid 2018 tax under the GILTI rules may be able to claim refunds.

IDR Releases Updated State Tax Guidance: GILTI & FDII - Iowa Department of Revenue. "Beginning in tax year 2019, Global Intangible Low-Taxed Income (GILTI) is included in individual and fiduciary (estates and trusts) income taxpayers' Iowa net income, but under recent legislation GILTI is excluded from income for Iowa corporate income and franchise tax purposes."

For federal filing purposes, individuals can elect to compute tax on their GILTI as corporations under Code Section 962, mitigating the worst of the tax. Iowa doesn't allow that: "If an individual is permitted to file as a corporation under the IRC, that fictional status is not recognized for Iowa purposes, and the individual's taxable income shall be computed as required under the IRC provisions relating to individuals not filing as a corporation."

Iowa has fixed a likely constitutional infirmity with respect to GILTI for corporations, but has left the infirmity in place with respect to foreign corporations owned by individuals directly or through pass-through entities. The law taxes income of foreign corporations with now Iowa connection or activity in cases where no tax would apply to similarly situated U.S. corporations. Unfortunately, Iowans have the choice of creating an otherwise unnecessary U.S. corporation to hold affected foreign corporation ownership, taking on the state in court, or moving to a more congenial state.

Republican Relief Package Expected This Week - Jad Chamseddine, Tax Notes ($). "While the measure is expected to make some changes to the tax law, Republicans are opposed to extending the supercharged unemployment benefits that are scheduled to expire at the end of the month, and they want to provide liability protection for businesses that open."

Second Stimulus Check - Wait For Something To Pass - Peter Reilly, Forbes. "The problem with thinking a lot about proposals is that they can get stuck in your heard and confuse when something different passes."

What a COVID-related payroll tax cut could mean to you now and your retirement later - Kay Bell, Don't Mess With Taxes. "Cutting payroll taxes, even fractionally and temporarily, could speed up the expected Social Security benefits shortfall date."

IRS Plans Follow-Ups for Delinquent High Earners - Nathan Richman, Tax Notes ($):

The IRS’s “Hi-Def” revenue officer sweeps brought many rich tax delinquents into compliance, but the IRS is planning another operation for those who didn’t fix their problems.

“In the months ahead, you’re going to be learning about a follow-up operation called ‘Surround Sound,’” Darren Guillot, deputy commissioner for collection and operations support, IRS Small Business/Self-Employed Division, said July 17.

Related: Increased IRS Compliance & How it Will Affect You

IRS Return Information Disclosures to Other Federal or State Authorities for Information Obtained in Voluntary Disclosure Processing and other Agency Activity - Jack Townsend, Federal Tax Crimes Blog. "In any event, in my opinion, it is pretty important to err on the side of overdisclosure rather than underdisclosure, in order to mitigate the risk that the IRS would claim underdisclosure as a basis for denying the taxpayer fully cooperated, a requirement for voluntary disclosure."

Estate Planner: Plan Ahead for Possible Biden Term - Jonathan Curry, Tax Notes ($). "Wealthy taxpayers will wish they had acted sooner if presumptive Democratic presidential nominee Joe Biden gets his way when it comes to tax hikes on the rich, an estate planner warned."

Related: Estate Planning is More Than Just Tax Planning

Lesson From The Tax Court: How Evil §481 Forces Income Recapture - Bryan Camp, TaxProf Blog:

Quoting from Suzy’s Zoo v. Commissioner, 273 F.3d 875, 883 (9th Cir. 2001) Judge Lauber tells us that “The purpose of § 481 is to prevent either a distortion of taxable income or a windfall to the taxpayer arising from a change in accounting method when the statute of limitations bars reopening of the taxpayer’s earlier returns.” Op. at 8. Notice that the provision does not re-open a closed year. Nor does it change the liability for the closed year. The closed year remains closed. What the provision does instead is force the taxpayer to account for errors made in the closed years in the year of audit, thus changing the tax liability for the year of audit.

In this case, the taxpayers depreciated buildings as five-year property. Sec. 481 let the IRS fix the accumulated error in the audit year.

Related: Cost Segregation: The Right Asset Classification Produces Huge Tax Savings

30+ Tax Tips From The Tax Pros - Kelly Phillips Erb, Forbes. "Don't be afraid of paying for an hour or two of a CPAs time."

Tax Return Filed With IRS, But Should You Amend It? - Robert W. Wood, Forbes. "You usually can’t correct a tax return without amending it. But there's an exception for some mistakes up until the normal due date—or your extended due date if you went on extension. If you file a ‘superseding’ return before the due date of the original return (including extensions), it can take the place of the originally filed return."

Second Circuit Agrees with Tax Court, Taxpayer's Property Was Not Used in a Trade or Business, Loss on Sale Was Capital - Ed Zollars, Current Federal Tax Developments. "The panel notes that there were only limited attempts to rent the property, but continuous efforts to sell the property..."

A Sun Has Set: Reflections on the Honorable John Lewis - Nina Olson, Procedurally Taxing. "Historians and advocates will assess his enormous contributions in the fields of human and civil rights. Here, today, I just want to share how John Lewis affected my life and my work."

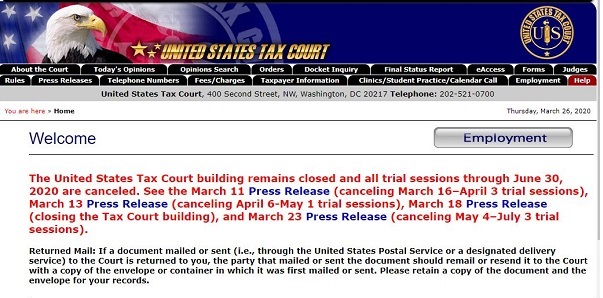

Farewell to the Iconic Tax Court Eagle. For those inclined to believe our great institutions are in decline, a visit to the new U.S. Tax Court home page will reinforce your pessimism. The new page:

Here is how it looked in March:

And pretty much the same in 2008:

#taxtwitter noticed the change. @taxgirl, AKA Kelly Phillips Erb, chimes in: "I don't like it AT ALL. It looks like someone wanted to look super corporate and yet former Eastern bloc all at the same time."

In fairness, any picture of the Tax Court Building can't help but look a bit Soviet. RIP, Tax Court Eagle.

Make a habit of sustained success.