Data Analytics Are Now Essential Anti-Tax-Shelter Tools - Kristen Parillo, Tax Notes ($):

The Justice Department and IRS are aggressively using data analytics to uncover tax shelters before they become systemic enforcement problems for the government.

“We are on the hunt for the next scheme, and we want to find it and we’re going to find it,” said David Hubbert, deputy assistant attorney general (civil matters), Justice Department Tax Division.

With a constrained budget, data crunching is probably one of the most cost-effective enforcement tools available to the IRS. With a low examination rate, the IRS has to make the ones it does count.

Of course, these tools are also available to state revenue officers, making it more important for businesses to stay on top of their state tax compliance.

What is Qualified Leasehold Improvement Property? - Tamara Hubbard, Thomson Reuters Tax And Accounting Blog. "Qualified Improvement Property (QIP) is a term found in the Internal Revenue Code, Section 168, and encompasses any improvements made to the interior of a commercial real property."

Since it qualifies for bonus depreciation, instead of 39-year depreciation, it's worth some effort to identify Qualified Improvement Property. Eide Bailly's Fixed Asset Services team can help.

IRS Sticks to Plan in Final PTIN Fee Regs - Jonathan Curry, Tax Notes ($). "The IRS has issued final regulations on return preparer tax identification numbers and associated user fees, despite ongoing questions related to its authority to impose such fees."

4 tax moves to make now if you didn't file on Tax Day - Kay Bell, Don't Mess With Taxes. "If you owe, take care of it as expeditiously as you can, to both get off the IRS' radar and limit the extra late-filing and non-payment penalties and interest."

Nontax Crimes Another Reason to Avoid IRS Voluntary Disclosure - Nathan Richman, Tax Notes ($). "It’s been clear since the IRS released its memo on the new voluntary disclosure practice that taxpayers with illegal-source income won’t get any benefit from the program, but on July 14 an IRS official said nontax illegal behavior disclosed in an IRS voluntary disclosure could be passed to nontax criminal investigators."

If you are trying to clean up your tax life, make sure you have a good guide through the process.

How Can The IRS Do Correspondence Audits When It Can’t Open Its Mail? - Janet Holtzblatt, TaxVox. "My advice to the IRS: Close those correspondence audits immediately and pay those refunds, even though some ineligible people will get credits. Many of those audited taxpayers are eligible, and many need the money now to pay for food and shelter."

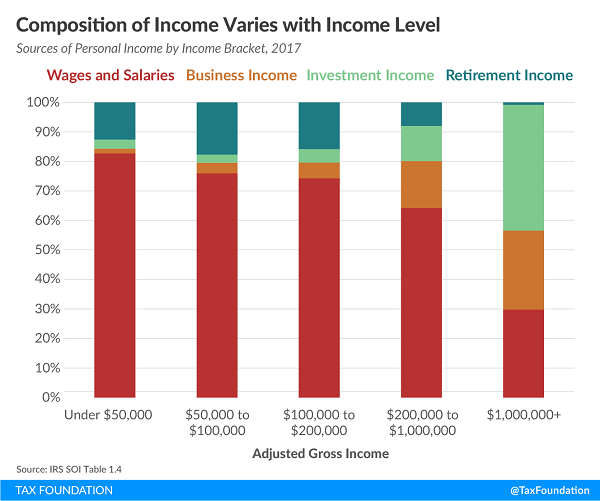

Sources of Personal Income, Tax Year 2017 Update - Garrett Watson and Everett Stamm, Tax Policy Blog. "About 68.8 percent ($7.5 trillion) of total income reported on Form 1040 consisted of wages and salaries, and about 82.5 percent of all tax filers reported earning wage income."

It's worth noting that a big chunk of income for those making over $1 million is business income - income from Schedule C, farming, and K-1s for closely-held businesses. A tax on "the rich" is inevitably a tax on businesses.

Transitioning the Farm or Ranch – Stock Redemption - Roger McEowen, Agricultural Law and Taxation Blog. "The primary advantage of a corporate stock redemption is that it can remove post-tax wealth that has built up inside the corporation at a 21 percent rate. "

Some Tax Terms Create Confusion, Such as "Automatic" - Annette Nellen, 21st Century Taxation. "The other day I saw a statement that you can get an "automatic" extension from the IRS, I thought I had missed something because I thought you still needed to file a Form 4868. I double-checked and you do still need to file the Form 4868 by July 15 to get an extension to file until October 15. So, here, "automatic" meant you don't have to offer a reason to get the extension, you just file the form."

Not everyone needs a schedule C. Long ago a practitioner acquaintance told me that she told all of her clients to have a Schedule C business, because "that way you can deduct things that you couldn't otherwise." A couple that tried that approach in Tax Court yesterday didn't do so well.

Schedule C is the tax form individuals use to report income from a wholly-owned unincorporated business. Items bought for business use are deductible when the same items are non-deductible as personal expenses. Common examples are travel, legal fees, and rent.

There is nothing wrong with deducting business expenses... if you actually have a business. And that's the problem the couple ran into. Tax Court Judge Ashford explains (taxpayer names omitted):

Petitioners offered no credible, objective evidence to establish a profit motive for Petitioner Spouse's marketing and brand consulting activities attributable to JW Consulting. Indeed, petitioners did not attempt to rebut their return position for the years at issue concerning these activities; to wit, that she had no gross receipts or other income for 2009, had nominal income for 2010 from a questionable source (i.e., $1,000 from CRG), and only allegedly incurred certain expenses. Except for a 2009 profit and loss statement for JW Consulting, they produced no other records — contracts, accounting records, invoices, and the like — traditionally associated with a business operating for profit.

The Judge ran up the score by finding the claimed expenses for the questionably-existing business to be inadequately documented. Decision for IRS, with "accuracy related" penalties imposed.

The Moral? If you want to deduct business expenses, make sure to start with an actual business. Then keep your receipts and maintain your records as though your tax life depended on it. It just might.

Cite: T.C. Memo. 2020-109

Make a habit of sustained success.