Today is the deadline. By the end of the day, calendar year 2019 1040s, 1041s, 990s and 1120s should be filed or extended. Some last-minute reminders:

- E-filing is the way to go wherever possible. You don't have to worry about documenting your timely filing, or about a mail truck catching fire. The IRS is months behind in processing mail as a result of its pandemic shutdown, so refunds will come much faster with e-filing.

- If you paper file, document your filing. Certified mail, return receipt requested, is a cheap and easy way to prove you filed on time.

- If you file after the post office closes, you can head to the Fed-Ex outlet or UPS store. Be sure to use one of the Authorized Private Delivery Services. Be careful - UPS Ground doesn't work, for example, but UPS Next Day Air does. Use the right service center street address, and keep your shipping documents as proof of timely filing.

- If you owe and can't pay, you still should file or extend, because you greatly reduce late penalties. The penalty for late filing is 5% of the amount due, plus 5% for each additional month of non-payment. If you file on time but don't pay the amount due, the penalty goes down to 1/2% per month.

- Consider a payment plan if you can't pay right now, you can apply online for an installment agreement.

- If you aren't done with your return yet, extending is likely your best bet. There is no evidence that extending increases your examination risk. It's a certainty that making errors in haste greatly increases the possibility that the IRS will be in touch.

IRS reminder: Taxpayers can get an extension to Oct. 15 to file taxes (IRS news release):

Individual taxpayers who need additional time to file beyond the July 15 deadline can request a filing extension to Oct. 15 in one of two ways:

- Filing Form 4868 through their tax professional, tax software or using Free File on IRS.gov.

- Submitting an electronic payment with Direct Pay, Electronic Federal Tax Payment System or by debit, credit card or digital wallet options and selecting Form 4868 or extension as the payment type. The automatic extension of time to file will process when taxpayers pay all or part of their taxes, electronically, by the July 15 due date.

Businesses that need additional time to file income tax returns must file Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

How to make the 2 estimated tax payments also due July 15 - Kay Bell, Don't Mess With Taxes. "When the IRS shifted the due date for both of this tax year's first and second quarter estimated tax payments to July 15, which everyone knows by now is the same day as regular annual tax returns are due, we're getting slammed fiscally this month."

Your Tax Refund May Be Late This Year: Here’s Why - Laura Saunders, Wall Street Journal ($). "On June 30, IRS Commissioner Chuck Rettig told the Senate Finance Committee that the IRS had an estimated backlog of 12.3 million paper tax returns or correspondence as of mid-June. As of July 4, that backlog had shrunk to 7.8 million, including about 3.6 million paper tax returns"

IRS Extends Filing Deadline for Tax-Exempt Hospitals - Frederic Lee, Tax Notes ($). "The IRS has extended the deadline for hospitals to comply with any community health needs assessment (CHNA) requirements until December 31."

Iowa guidance bites taxpayers with big 2019 business losses: IDR Releases New State Tax Guidance: Iowa Nonconformity CARES Act of 2020 - Iowa Department of Revenue. Some highlights:

- Iowa won't tax economic impact payments.

- Iowa will conform to federal treatment of PPP loan forgiveness (non-taxable) and expense disallowance under Notice 2020-32.

- Iowa has its own net operating loss rules, and does not conform to the new federal five-year carryback for 2018-2020.

- Iowa does not apply the new relaxed interest deduction rules for 2019 that apply to federal filings. Iowa does not apply the Sec. 163(j) limits at all for 2020 and beyond

The Iowa rules applying the excess business loss limits for 2019 have a nasty bite. From the Iowa guidance (my emphasis):

NOTE FOR TAX YEAR 2020 AND LATER: For federal tax purposes, excess business losses disallowed in a tax year are included in the computation of the taxpayer’s federal net operating loss (NOL) carryforward to subsequent tax years. However, Iowa NOLs are computed independently of federal NOLs, and there is no provision in Iowa law that permits excess business losses disallowed for Iowa purposes to be included in the calculation of an Iowa NOL or otherwise deducted in a later year. As a result, excess business losses disallowed (i.e. added back as income) for Iowa tax purposes are not deductible in a later tax year and are lost.

The only hope for a fix here is legislative action.

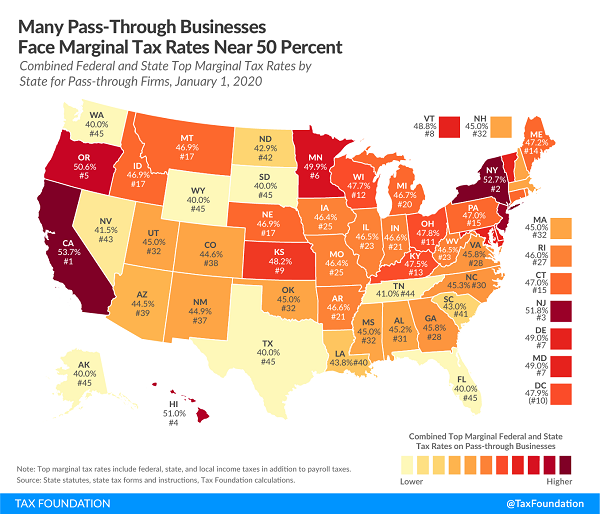

Marginal Tax Rates for Pass-through Businesses by State - Garrett Watson, Tax Policy Blog. "Top marginal tax rates faced by pass-through firms also vary by state, ranging from 40 percent in states with no state and local income tax, like Wyoming and Florida, to 53.7 percent in California. These combined rates include federal, state, and local income taxes in addition to payroll tax."

Apple Wins Major Tax Battle Against EU - Valentina Pop and Sam Schechner, Wall Street Journal ($). "Apple Inc. won a major battle with the European Union when the bloc’s second-highest court on Wednesday sided with the U.S. company over a €13 billion ($14.8 billion) tax bill that EU antitrust officials had said the company owed to Ireland."

Marching Through Georgia - Class Action Lawsuits Against Conservation Syndicators - Peter Reilly, Forbes. "Class action attorneys led by David Deary have filed two lawsuits against promoter groups."

Tax Day 2020 Specials, Freebies & Deals A Lot Lighter Than In Past Years - Kelly Phillips Erb, Forbes. "That means that today brings to an end (well, sort of) a long, drawn-out tax season. Normally, that would be cause for celebration since Tax Day usually means specials, freebies, and deals. But things are definitely lighter this year than last."

Is there nothing that 2020 can't screw up?

Make a habit of sustained success.