IRS gives tips on filing, paying electronically and checking refunds online; 2019 tax returns and payments due July 15 - IRS press release.

Tomorrow is April 15, Midsummer Edition, and taxes are due. The IRS lists some "common errors to avoid":

-

Missing or inaccurate Social Security numbers. Enter each name and SSN exactly as printed on the Social Security card.

-

Incorrect filing status. The Interactive Tax Assistant on IRS.gov can help taxpayers choose the correct status. Tax software also helps prevent these mistakes.

-

Math errors. Tax preparation software does all the math automatically. Math errors are common on paper returns.

-

Figuring credits or deductions incorrectly. Taxpayers should follow the instructions carefully, and double check the information they enter when filing electronically. The IRS Interactive Tax Assistant can help determine if a taxpayer is eligible for certain tax credits.

-

Unsigned returns. Both spouses must sign if filing jointly. Taxpayers can avoid this error by filing their return electronically and digitally signing it. Exceptions may apply for military families if a spouse is serving overseas.

-

Filing with an expired individual taxpayer identification number.

Many errors come from rushing to beat the deadline because of superstitious fear of extending a return. There is no evidence that extending a return increases your audit risk. By contrast, there is plenty of evidence that mistakes made in haste do increase your risk of hearing from the IRS.

A list of deadlines delayed until July 15 is available here.

IRS' COVID-19 tax payment postponements also end July 15 - Kay Bell, Don't Mess With Taxes:

When the IRS established its COVID-19 (non)operation plan, most of it accounted for in the aforementioned People First Initiative, it paused payments of IRS installment agreements that were then in effect.

That meant taxpayer payments that were due between April 1 and July 15 were delayed. Note that while you weren't charged for not paying, interest continued to accrue over these last three months.

That payment grace period is about to end.

Just one more way life goes on during a pandemic, I guess.

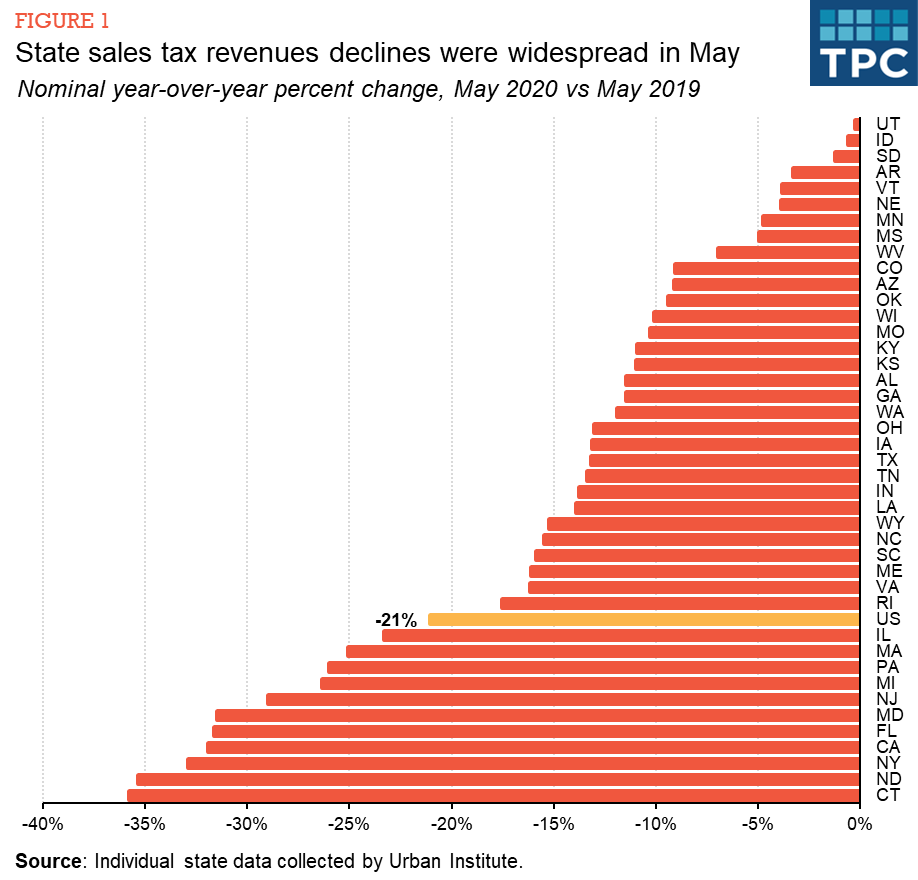

The COVID-19 Effect: State Sales Tax Receipts Shrank $6 billion in May - Lucy Dadayan, TaxVox. "For example, year-over-year revenues fell only slightly in Utah and Idaho but plummeted by more than one-third in Connecticut, New York, and (surprisingly) North Dakota."

A picture from the post says a lot:

It's safe to assume this provides states even more motivation to use their new powers under the Wayfair decision to collect taxes from out-of-state businesses.

Bozo Tax Tip #1: Move Without Moving! - Russ Fox, Taxable Talk. "If you really do relocate, a residency audit is a minor annoyance. But let’s say you reside in Silicon Valley, and you buy a home in Reno but keep your home in Los Altos. Did you move? Or did you just move in name?"

Algebraic Solutions for Computing TCJA Deductions Not Dead Yet - Emily Foster, Tax Notes ($). "Treasury and the IRS have been grappling with Congress’s decisions in multiple Tax Cuts and Jobs Act statutes to impose limitations on deductions based on taxable income without contemplating ordering rules in the legislation. That tendency leads to the question of which deduction comes first, and whether ordering rules or simultaneous equations are the path of least resistance."

Say Uncle! I haven't seen the IRS get so excited about a winning day in Tax Court before this news release: Tax Court strikes down 4 more abusive syndicated conservation easement transactions; IRS calls on taxpayers to accept settlement offers in syndicated conservation easement cases.

From the release:

WASHINGTON — On July 9, the U.S. Tax Court struck down four more abusive syndicated conservation easement transactions. The Internal Revenue Service calls on any taxpayer involved in syndicated conservation easement transactions who receives a settlement offer from the agency to accept it soon.

These time-limited settlement offers, announced June 25, are only being made to certain taxpayers with pending docketed Tax Court cases involving this type of abusive transaction.

These and other recent Tax Court decisions support the abusive nature of the underlying syndicated conservation easement deduction. The four most recent U.S. Tax Court decisions disallowed conservation easement deductions totaling nearly $21 million.

The syndicated easement shelters strike me as dodgy for reasons Peter Reilly has explained, so the IRS "deal" may turn out to be the best offer available. Even so, it's best to talk to somebody who understands IRS controversy issues before signing anything.

Lesson From The Tax Court: The #1 Habit Of Highly Successful Taxpayers - Bryan Camp, TaxProf Blog. "The case is an object lesson on the importance of taxpayers properly accounting for business expenses and personal expenses. Careful accounting is probably the #1 Habit of Highly Successful Taxpayers."

IRS Large Case Examination Rate Collapses - Keith Fogg, Procedurally Taxing. "For anyone who thinks it’s actually a good idea for the IRS to audit a reasonable number of returns to keep the system honest, the pictures here do not provide much encouragement."

Attracting Manufacturing to the U.S. Should Start with Neutral Tax Treatment, Not Subsidies - Alex Muresianu, Tax Policy Blog. "The main purpose of the tax code should be creating a neutral, pro-growth environment, which can help keep manufacturing here or bring some factories back from abroad. It might make sense for geopolitical reasons for a specific industry to headquarter in the United States, but policymakers have tools other than the tax code to achieve those ends."

Vacation home sale loss takes a holiday. After the last recession, many real estate owners found themselves trying to sell property for less than they paid for it. When the property is a vacation home, that has a bad tax result, as losses on sales of personal use property are non-deductible.

A New York state couple tried to get around that problem by claiming on their tax return that they had turned their property into a rental property before selling it. As business losses are deductible, that solves the problem -- doesn't it? Not in this case, as Tax Court Judge Halpern explains (my emphasis, taxpayer names omitted):

In her opening brief, [spouse] claims that petitioners "effectively changed the use of the * * * [Gearhart] property in 2009" and that, as a consequence, their loss on the sale of that property was a "Section 1231 loss".6 Thus, she implicitly claims that, when she and her husband sold the Gearhart property, they had used it in a trade or business. See sec. 1231(a)(3)...

We need not decide whether petitioners' occasional rentals of the Gearhart property to family and acquaintances are sufficient to establish a trade or business. Even if we were to accept that petitioners converted the property to use in a rental business in 2009, we would still sustain respondent's disallowance of the loss deduction they claimed from their sale of the property because they have not established that the adjusted basis of the property at the time of sale exceeded the amount realized on the sale. If the Gearhart property were worth less than its cost when petitioners converted it to rental use, their basis in the property would have been reduced to its value. See sec. 1.165-9(b)(2), Income Tax Regs. The basis would have been further reduced by the depreciation petitioners claimed in respect of the property. Petitioners would thus have incurred a loss on their sale of the property only if its date-of-conversion value (less depreciation) exceeded the amount realized. See sec. 1001(a). The record includes no evidence, however, concerning the value of the Gearhart property when petitioners began renting it out in 2009.

The Moral: If you convert property from personal to business use, you have to determine the value of the property at the time you make the conversion. If it is less than what you paid for it, you only get a deductible loss if your property declines even further in value. This is a case where "deathbed conversions" don't work.

Cite: T.C. Memo. 2020-108

Make a habit of sustained success.