One week left. Calendar year federal tax 2019 filings for individuals, trusts, C corporations and non-profits are all due one week from today. The normal April 15 due date (May 15 for non-profits) was extended to July 15 as a result of the COVID-19 pandemic. The IRS announced last week that the due date will not be pushed back further.

Taxpayers may claim automatic extensions of the due dates. Individuals claim the extensions on Form 4868, while corporations file Form 7004. The non-profit extension form is Form 8868.

The best way to file these forms is electronically. If you use paper, be sure to document your timely filing via Certified Mail, Return Receipt Requested, or by using an AUTHORIZED private delivery service and the IRS service center street address.

Extending the filing date does not extend the payment date. You should be prepared to pay what you owe. If you are an estimated tax filer, the first two quarters of federal estimated tax payments are also due July 15. Many extenders include the estimated tax payments with the extension and then apply the resulting 2019 overpayment to their 2020 taxes when they file for 2019.

If I have to pay, why bother extending? If you owe taxes, the penalty for late filing starts at five percent of the underpayment, increasing by another 5% for each additional month of late filing. If you extend and file by the extended due date, you avoid the late filing penalty. Even if you can't pay with the extension, you reduce the 5% late filing penalty to a 1/2% late-payment penalty.

What about states? Extension rules vary widely state-by-state. The AICPA has a summary of state tax deadlines under the epidemic. Visit the state revenue department of revenue websites for extension information, or contact your Eide Bailly tax professional.

When Are Income Taxes Due? Here’s What You Need to Know - Laura Sanders, Wall Street Journal ($). "One quirk of the delayed deadline means many Americans will receive interest payments from the IRS on their refunds."

Tax Filing Deadline Brings Possible Scammers - AJ Taylor, KIOW. "The IRS will not contact you by phone, email or social media to ask for personal information."

Applying for a tax payment plan - Kay Bell, Don't Mess With Taxes. "Are you one of those folks who's worrying about how you'll pay your tax bill on July 15? If it's an amount that you just can't come up with or cover with a credit card, look into paying off Uncle Sam over time."

Bozo Tax Tip #6: The $0.55 Solution. Russ Fox, Taxable Talk. "About thirteen years ago one of my clients saved $2.42 (I think that was the cost of a certified mail piece then) and sent his return in with a $0.37 stamp. It never made it. He ended up paying nearly $1,000 in penalties and interest…but he did save $2.42."

When Do We Have to File and Pay Our Federal Taxes This Year? - Tom Greenaway, Procedurally Taxing. "Most years, the due dates for federal tax filings and payments are obvious. This year, the answers are not so clear, especially as disruption caused by the COVID-19 pandemic continues to spread through the summer."

Rules on Farming Co-Ops Under 199A Coming Any Day Now - Eric Yauch, Tax Notes. "The statutory language of section 199A originally encouraged grain sales to agricultural co-ops instead of independent companies. Congress changed that so-called grain glitch in March 2018 with the Consolidated Appropriations Act, 2018, after businesses complained about the provision."

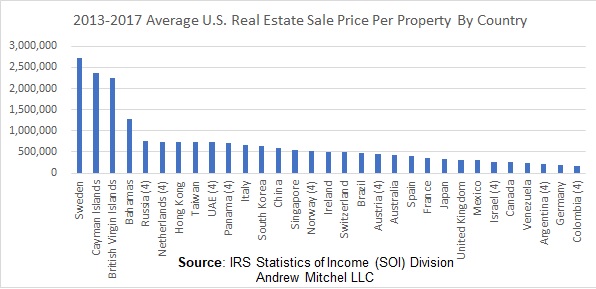

Average Price of U.S. Real Estate Sold - By Country - International Tax Blog:

When a foreign person disposes of U.S. real property, the buyer is required to file Form 8288-A. The IRS release breaks out the following data by country:

- The number of forms filed,

- The total sales, and

- The Federal income tax withheld.

The average sale price per property for each seller’s country can be determined by dividing the total sales by the number of forms filed. The average sale price can vary significantly from year to year. Therefore, the chart below reflects the average sale price per property for the 5 years from 2S013 to 2017.

This withholding requirement can be a nasty surprise to a real estate buyer. Always take the time to get certification from real estate buyers, or you might end up holding the bag for the tax you were supposed to withhold when you bought the property.

More Developments Concerning Conservation Easements - Roger McEowen, Agricultural Law and Taxation Blog. "The saga of claimed charitable deductions for donated conservation easements will continue. It seems that nothing generates more Tax Court litigation than a Code provision that the IRS despises."

Cafeteria Plan Did Not Convert Life Insurance Coverage Into Non-ERISA Benefit - Thomsen Reuters Tax and Accounting Blog. "The result in this case is not surprising, but it highlights some fundamental issues. While in general, a cafeteria plan is not itself an ERISA plan, the benefits paid for through a cafeteria plan may be subject to ERISA, and ERISA considerations can arise when a cafeteria plan is used as a funding mechanism for ERISA benefits."

Paycheck Protection Shaming - Just Stop It - Peter Reilly, Forbes. "The President through Trump Properties owns a lot of real estate. There are a lot of tenants. What would be a story is if none of them took PPP money."

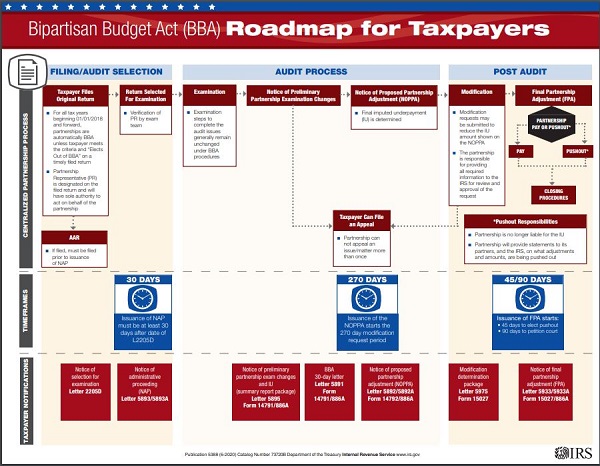

Modern Art. An IRS chart of the rules for auditing partnerships that apply starting with 2018 filings:

D.C. Proposal to Include Advertising in Sales Tax Won’t Work as Advertised - Jared Walczak, Tax Foundation. "But it turns out there are good reasons why advertising is almost always excluded from the sales tax, reasons which go both to core principles of taxation and practicalities about who could be taxed."

How the Espinoza Tax Credits Work - Sam Brunson, The Surly Subgroup. " I found the Supreme Court’s decision unsurprising (for reasons that I mention on the other blog). But one part of their analysis jumped out at me as reflecting a critical misunderstanding of the way Montana’s tax credit scheme worked."

Another reason to e-file. Post Office Delivery Trucks Keep Catching on Fire (Vice.com)

Make a habit of sustained success.