Updated PPP Forgiveness Application: What the New Guidance Means for You – Adam Sweet, Eide Bailly.

Notable items from the guidance include 8 vs 24 week cover period, eligible payroll expenses, a new EZ form for forgiveness, and timing considerations to consider.

U.S. Withdrawal From Digital Talks Marks ‘Collective Failure’ – Elodie Lamar and Sarah Paez, Tax Notes ($). “U.S. Treasury Secretary Steven Mnuchin told the finance ministers in a letter dated June 12 that OECD discussions regarding a global approach to taxing the digital economy have reached an impasse and that the United States won’t accept even interim changes that affect U.S. technology companies. The letter reiterated threats to retaliate if these countries implement their own digital services taxes.”

After U.S. Declares Impasse on Digital Taxes, Europe Continues Push – Sam Schechner, Wall Street Journal ($). “European officials are pushing forward with plans to tax tech giants after the U.S. declared international talks on the issue to be at an impasse, raising the specter of trans-Atlantic trade conflict.”

“French Finance Minister Bruno Le Maire said Thursday that France will resume collecting a 3% tax on revenue from digital services if countries from around the world can’t agree on a system for reallocating tax revenues from tech giants by the end of 2020.”

Still waiting for your COVID payment? IRS has answers on what to do to get or track your money – Kay Bell, Don’t Mess With Taxes.

The IRS has updated four questions and answers on its’ Get My Payment FAQ:

- My payment was mailed weeks ago, but the Post Office was unable to deliver it. What should I do?

- My address has changed or is incorrect. What can I do to change or correct it to receive my payment?

- Get My Payment shows that my I was issued but I never received it. How do I get a new one?

- I never received my payment after it was issued or I received it and it was lost, stolen, or destroyed. Can I initiate a trace on my payment using Get My Payment?

If the Lawyers Had Followed the Rules… – Russ Fox, Taxable Tax.

Long story short, read the IRS’s rules….. A tax payers petitions were dismissed due to using a shipping service not on the IRS’s official list. The official list can be found here.

"In today’s ruling of the Ninth Circuit in Organic Cannabis Foundation, LLC v. Commissioner, the Court begins:

This unhappy case presents a cautionary tale about the need for lawyers to ensure that they have done exactly what is statutorily required to invoke a court’s jurisdiction. The unusual Internal Revenue Code (“I.R.C.”) provision at issue here allows taxpayers to benefit from a “mailbox” rule—i.e., that a document will be deemed filed when dispatched—only if the taxpayer uses one of the particular delivery services that the Internal Revenue Service (“IRS”) has specifically designated for that purpose in a published notice."

Why You Should Keep Tax Records For More Than Three Years – William Baldwin, Forbes. “There is indeed a three-year rule on tax audits, but it doesn’t provide the protection you think it does. Normally the IRS has three years from a return’s due date (or when you filed, if you got an extension) in which to challenge your numbers.”

IRS Processing Paper Returns, Faces Mail Backlog of 11 Million – Wesley Elmore, Tax Notes ($). “The IRS has begun processing paper tax returns, but it has a backlog of 11 million pieces of unopened mail, so taxpayers should expect delays in receiving their refunds.”

“We’re experiencing delays in processing paper tax returns due to limited staffing. If you already filed a paper return, we will process it in the order we received it,” the IRS said. “Do not file a second tax return or contact the IRS about the status of your return or your Economic Impact Payment.”

NOL, Interest Deductions Should Be Extended, Economist Says – Alexis Gravely, Tax Notes ($). “Congress should extend the changes made to net operating losses and business interest deductions as a part of further tax relief during the coronavirus pandemic, according to one witness at a congressional subcommittee hearing.

“There are still a lot of individuals and businesses that need relief,” Kyle Pomerleau of the American Enterprise Institute said at a June 18 hearing of the House Ways and Means Select Revenue Measures Subcommittee. “For businesses, I think that if the downturn continues and the economy is still south, I think that extending the net operating loss provision or the expansion of the net interest deduction provision is appropriate.”

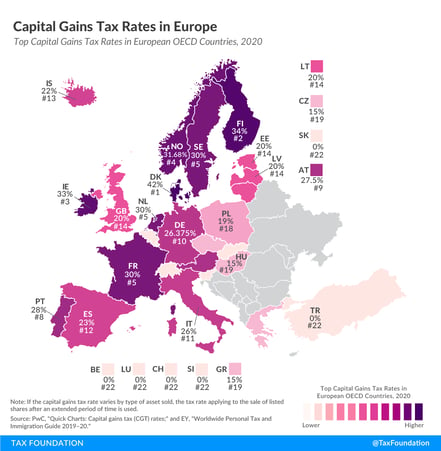

Capital Gains Tax Rates in Europe – Elke Asen, Tax Policy Blog. "In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Today’s map focuses on how capital gains are taxed, showing how capital gains tax rates differ across European OECD countries."

Make a habit of sustained success.