New SBA Frequently Asked Question #45 allows employer retention credit if PPP loan repaid by May 14. From the FAQ:

Question: Is an employer that repays its PPP loan by the safe harbor deadline (May 14, 2020) eligible for the Employee Retention Credit?

Answer: Yes. An employer that applied for a PPP loan, received payment, and repays the loan by the safe harbor deadline (May 14, 2020) will be treated as though the employer had not received a covered loan under the PPP for purposes of the Employee Retention Credit. Therefore, the employer will be eligible for the credit if the employer is otherwise an eligible employer for purposes of the credit.

Something more for taxpayers to think about in light of the uncertainty for deduction of expenses leading to PPP forgiveness.

Related: IRS Says No Deduction for PPP Loan Expenditures

Small Business Loan Deduction Bill Puts Ball in IRS’s Court - Jad Chamseddine, Tax Notes ($). "A bipartisan group of lawmakers introduced legislation clarifying their intent to make business expenses associated with the Paycheck Protection Program (PPP) deductible as they continue negotiations with the IRS."

The measure comes in response to IRS Notice 2020-32, 2020-21 IRB 1, released April 30, which says that to the extent that income resulting from loan forgiveness under the PPP is excluded from income, it is considered a “class of exempt income” under regulations promulgated for section 265.

Meanwhile, the legislators are pushing the IRS to reverse its position.

Related: IRS FAQs on Employee Retention Credits and How They Apply to You

IRS Wants Its Money Back From the Dead - Frederic lee and Jad Chamseddine, Tax Notes ($). "The updated FAQ, posted May 6 on the agency's website, contrasts with earlier guidance that said families that received extra stimulus funds for ineligible children didn't have to return the funds."

Employee Treatment Remains a Mystery for CARES Act Tax Credit - Eric Yauch, Tax Notes. "Businesses looking to receive refundable employment tax credits still aren’t sure how to treat wages paid to salaried and part-time employees, even after the latest round of IRS guidance."

New England duo charged with fraudulently seeking coronavirus relief loans - Kay Bell, Don't Mess With Taxes. "As part of the allegedly false applications, federal prosecutors say the duo claimed to have dozens of employees earning wages at four different business entities. In fact, say officials, none of the businesses had any workers."

Iowa Small Business Relief Tax Deferral Program continues with second round - Iowa Department of Revenue. "Iowa Director of Revenue Kraig Paulsen has announced businesses in Iowa can continue to apply for a deferral of state sales and/or withholding tax."

Washington Governor Issues Proclamation Extending DOR Waivers - Tax Notes ($). "Washington Gov. Jay Inslee (D) issued a proclamation extending a previously issued proclamation that ordered waivers of penalties, fees, and interest imposed by the Department of Revenue on taxpayers affected by COVID-19; the statutes are in place until the declaration of emergency is lifted or May 31, 2020, whichever occurs first."

Link to proclamation here.

Does Your State Tax Business Inventory? - Janelle Cammenga, Tax Policy Blog. "When possible, state and local governments should look to shift from inventory taxes toward revenue sources with broader, more neutral bases."

Payment Alternatives in the Covid Era: A Humble Plea for Easier Access to Installment Agreements - Caleb Smith, Procedurally Taxing. "I’d like to focus on an issue that practitioners come across frequently: frustration with installment agreements (IAs) (see PT posts here and here). Specifically, I want to look at how the IRS can systematically make the process easier and more affordable by expanding access to “streamlined” 84-month IAs."

CARES Act Support Is Falling Short - Renu Zaretsky, TaxVox. "The Urban Institute reports that more than 30 percent of adults have reduced spending on food, 43 percent have put off major purchases, and nearly 28 percent have tapped savings accounts or increased credit card debt."

Ten Days (More Kudos to the IRS) - Russ Fox, Taxable Talk. "Yes, more work is needed for the Get My Payment website. It doesn’t work for expatriates (individuals residing outside the United States), many of whom do qualify for the payments. But overall the IRS deserves praise for getting this done and being able to serve most Americans within 30 days of the legislation passing."

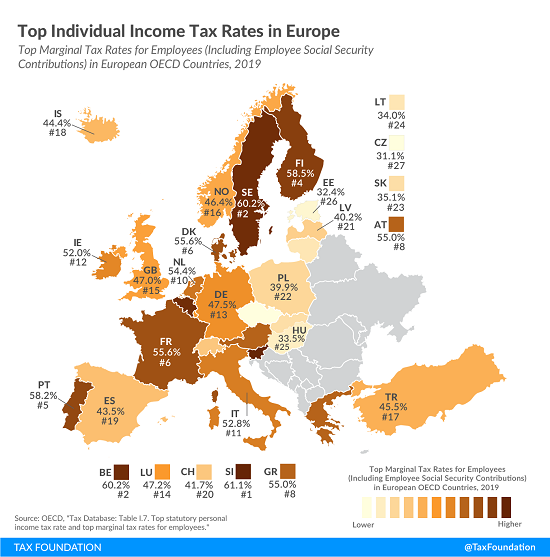

Top Individual Income Tax Rates in Europe - Elke Asen, Tax Policy Blog. "Slovenia (61.1 percent), Belgium (60.2 percent), and Sweden (60.2 percent) had the highest top marginal income tax rates among European OECD countries in 2019. The Czech Republic (31.1 percent), Estonia (32.4 percent), and Hungary (33.5 percent) had the lowest rates."

The post also has a chart showing the taxable income threshold where the top rate kicks in. Sweden's 60.2% top rate applies to taxable income over $78,821. For comparision, the the top U.S. rate of 37% applies to single filers for taxable income over $510,300.

Judge Urges Prison Furlough For Author Of “Biggest Tax Fraud Ever” - Peter Reilly, Forbes. Peter takes us back to the turn of the century, when some of the most prestigious law and accounting firms began marketing tax shelters with names like "HOMER," "BOSS," and "CARDS." A once-prominent attorney seeks a furlough from a long prison term out of fear of COVID-19: "He orchestrated the largest tax shelter fraud scheme in American history-one that recruited ultra-wealthy taxpayers and corrupted young professionals at every turn. Daugerdas netted over $95 million in illicit proceeds for his own benefit, and the United States Treasury lost more than $1 billion in tax revenue."

Today in History: Germany surrenders unconditionally to the Allies at Reims (History.com). 75 years ago today.

Make a habit of sustained success.