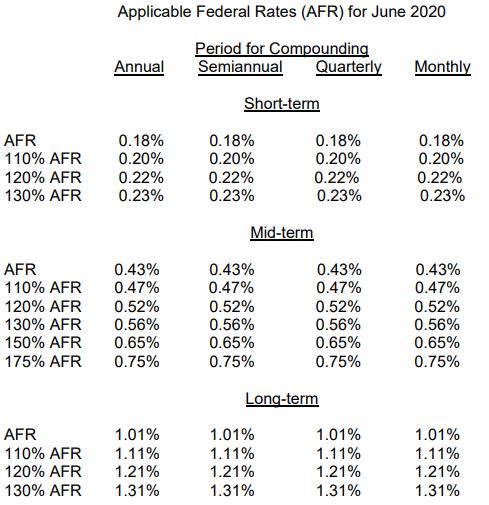

The IRS has released (Rev. Rul. 2020-12) the Applicable Federal Rates under Sec. 1274(d) of the Internal Revenue Code. These rates are used for various tax purposes, including minimum rates for loans.

There are rates for "short-term," "mid-term," and "long-term" instruments. Short-term covers demand loans and instruments extending up to three years. Mid-term covers loans cover instruments of over three years up to nine years. Long-term covers instruments with maturities longer than nine years.

The Section 382 long-term tax-exempt rate for corporation ownership changes during June 2020 is 1.09%

Related: Eide Bailly Mergers & Acquisition services.

Historical AFRs are available here.

Make a habit of sustained success.

Every organization deserves to realize its full potential. Let us help you find yours.

Learn More