Paycheck Protection Program Loans – The Good, The Bad, And The Ugly – Brock Blake, Forbes. “Ideally, the SBA will also approve all banks, credit unions, and legitimate fintech lenders to participate in this next round so that those small business customers that were placed at a disadvantage in the first round will become the priority in round two.”

Related: How to Maximize Your Loan Forgiveness Under the Paycheck Protection Program

Shake Shack Will Return Its Entire $10 Million U.S. Government Loan – Derek Wallbank, Bloomberg.

The CARES Act geared SBA loan availability towards small businesses but unfortunately many were left out as the $349B allocated for the Paycheck Protection Program quickly ran dry.

An earlier statement from the SBA and the Treasury Department said that the 'vast majority of these loans -- 74% of them -- were for under $150,000, demonstrating the accessibility of this program to even the smallest of small businesses.' But an SBA report showed that about 2% of the firms approved for loans accounted for almost 30% of the funding.

Additional funding for the PPP and other programs is being discussed in Congress, with potential focus on underserved areas.

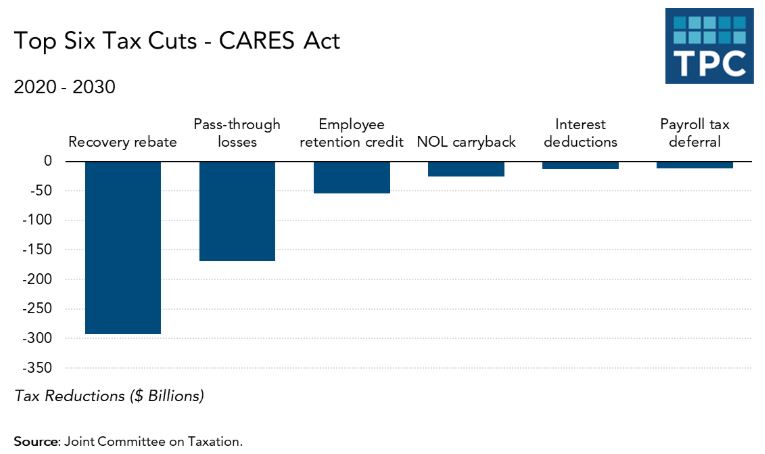

Who Benefits From The CARES Act Tax Cuts – Thornton Matheson, TaxVox. “Nearly all of the remaining cuts will go to business, although workers may benefit from some of these. More than a quarter of the tax cuts go to taxpayers in the top income decile.”

Paycheck Protection Program – Deductibility Dilemma – Peter J Reilly, Forbes. “A strong argument that 265 does not apply is that it kind of makes the exclusion in the CARES Act kind of pointless. Hopefully the IRS will rule on this soon.”

An article by Tax Notes ($), Double Tax Benefits in the CARES Act, explains why employer deductions for PPP expenses should be unaffected.

The CARES Act includes no similar provision [to IRC section 108(b)] denying deductions or reducing tax attributes. Absent this type of provision, expenses paid by the SBA loan are arguably deductible.

The article also points out IRC section 265 would not likely apply as PPP expenses are not allocable to a class of income exempt from tax, but instead initially from loan proceeds.

100 Payroll Tax and Fringe Benefit Questions for the IRS on COVID-19 Measures – Bloomberg Tax

Treasury and the IRS are working hard to provide guidance around CARES Act provisions, but many questions remain or have popped up that have employers hesitant to move forward until we have some clarifications. No pressure but time is of the essence.

The authors’ sincere hope that this list will help the guidance-drafters compile a comprehensive list, for use in issuing prompt (and hopefully taxpayer-favorable) responses to all of these questions.

These answers, and many more surrounding other provisions, must come accurately and swiftly to fully implement benefits intended.

How Millions of Women Became the Most Essential Workers in America – Campbell Robertson and Robert Gebeloff, New York Times. “The work they do has often been underpaid and undervalued — an unseen labor force that keeps the country running and takes care of those most in need, whether or not there is a pandemic.”

COVID-19 Tax Deadlines, Updates, Stimulus Checks: All You Need To Know – Manasa Sog Nadig, The Buzz About Taxes. “The stimulus payment in theory is based on your residency status and your social security number. If you are on an immigrant visa like H1-B/ L1 etc., have a SSN and have fulfilled substantial presence requirements in the US for 2018/ 2019 and are therefore considered a "resident alien", you should be eligible for the stimulus check.”

How to take retroactive 100% bonus depreciation on QIP – Sally P. Schreiber, Journal of Accountancy. “Friday’s guidance explains how taxpayers can change their depreciation under Sec. 168(e) for QIP placed in service after Dec. 31, 2017, in a tax year ending in 2018, 2019, or 2020 to take advantage of the fix.”

Related: What You Need To Know About The CARES Act

States Should Be Allowed to Levy Sales Taxes on Internet Access – Ulrik Boesen, Tax Foundation. “On July 1, sales taxes levied on internet access in six states—Hawaii, New Mexico, Ohio, South Dakota, Texas, and Wisconsin—will become illegal under the provisions of the Permanent Internet Tax Freedom Act (PITFA).”

Related: States Are Looking for More Money: How to Protect Yourself

Denver risking tax dollars by “ineffectively” auditing marijuana businesses, city auditor alleges – Tiney Ricciardi, The Denver Post. “Officials also have failed to address several unlicensed marijuana delivery services active in the city, the report said.”

Tax Trivia

What common item was first taxed as a luxury in 1898, at the start of the Spanish-American War, and continues to be taxed today?

Answer: The telephone!

Make a habit of sustained success.