Treasury economic stimulus payments are rolling out and unfortunately so are related scams. A new website is now available to learn about and report such IRS-related cons.

The Federal Trade Commission (FTC) has also issued nine warning letters to VoIP service providers and other companies who have assisted or facilitated illegal COVID-19 related telemarketing or robocalls. Follow the FTC’s tips on avoiding Coronavirus scams.

Scammers also continue to look for ways to infiltrate businesses with the world transitioning to work-from-home arrangements. Don't miss our upcoming webinar on Cybersecurity Trends in 2020 on Tuesday, April 21, 2020 11a.m. CDT. Register here!

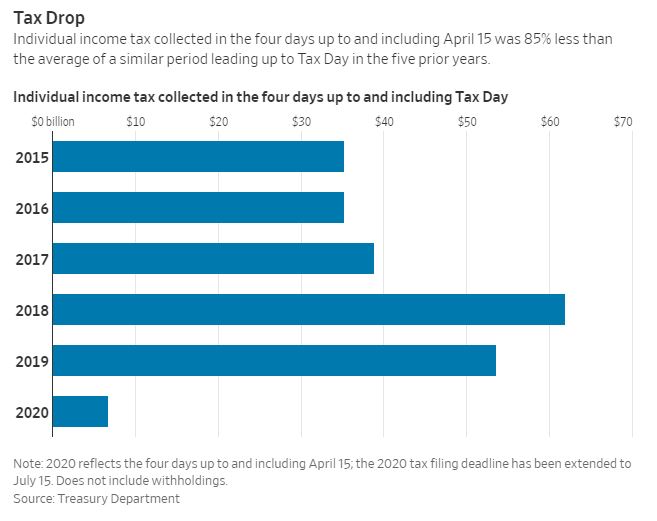

The Year the Coronavirus Turned Tax Day Upside Down – Richard Rubin and Anthony DeBarros, WSJ ($)

Taxes are the major moneymaker for the government, especially in April. But this year with due dates on extension, CARES Act opportunities, and economic stimulus payments - we have entered the upside-down.

“The tax system ran in reverse, with $17 billion coming in and $151 billion going out as refunds, according to Treasury Department data released late Thursday" said Rubin and DeBarros.

WSJ Graphic

The IRS Is Getting Out Coronavirus Rebate Payments: Congress Needs To Think About A Second Round – Elain Maag, TaxVox. “More cash payments could complement other efforts targeted to those hit hard economically by the pandemic. These other efforts might include a further extension of unemployment benefits or increasing the size of regular SNAP (food stamp) payments to reduce food insecurity. Cash could fill in remaining gaps, including costs of health care, rent, or caregiving.”

SSI recipients to receive automatic stimulus payments for coronavirus – Michael Cohn, Accounting Today. “The Treasury anticipates SSI recipients will receive these automatic payments no later than early May.”

Disrupted Economic Activity and Force Majeure – Avoiding Contractual Obligations in Time of Pandemic – Roger A. McEowen. “Is the present virus a covered event? Some hog integrators think so, as do some ethanol plants and milk buyers. Some of these parties are having their suppliers allege force majeure on them, citing current market conditions as a result of executive orders of state governors.”

Practitioners Lament Employment Tax Deferral as PPP Loans Dry Up – Eric Yauch, Tax Notes ($)

The PPP ran through its allocated $349B recently and businesses evaluate other CARES Act options to stay afloat. Employment tax deferral is available but some worry the program only kicks the problem can down the road for failing businesses.

Joe Kristan, Eide Bailly partner, noted in the article,

It’s borrowing without collateral or credit evaluation, and that often ends badly. When the deferral comes due, it might put the business over the edge.

The CARES Act pitted the PPP against the employment tax deferral, disallowing the deferral when PPP loan forgiveness is utilized. However, the IRS explained that employers who have received a PPP loan may use the payroll tax deferral through the date the lender issues a decision to forgive the loan.

Another option for those not using the PPP is the Employee Retention Credit, potentially worth up to $5,000 per employee.

IRS ‘People First’ COVID-19 effort eases collections, audits – Kay Bell, Don’t Mess With Taxes. “The most obvious tax problems are those faced by folks who owe but, even before the virus spread across the United States, were having difficulty paying.”

Related: IRS Changing Operations Due to COVID-19

Kleiman: Tax Limits and The Future of Local Democracy – Paul Caron, TaxProf Blog. “Property tax limits are state-level laws that place caps on local governments’ tax rate and revue…which puts pressure on already strapped cities and counties.”

April 17th Morning State Tax Update – Katherine Loughead, Tax Foundation. “Most states are required by law to end their fiscal year with a balanced budget, some will have to consider revenue transfers, borrowing, or spending reductions to end the year without a deficit.”

Tax Trivia

What common item was first taxed as a luxury in 1898, at the start of the Spanish-American War, and continues to be taxed today?

Check back on Monday for the answer! Hint...can you hear me now?

Make a habit of sustained success.