Treasury Updates Paycheck Protection Program Loan FAQ. Now 18 questions are answered, including this one:

7. Question: The CARES Act excludes from the definition of payroll costs any employee compensation in excess of an annual salary of $100,000. Does that exclusion apply to all employee benefits of monetary value?

Answer: No. The exclusion of compensation in excess of $100,000 annually applies only to cash compensation, not to non-cash benefits, including:

-

employer contributions to defined-benefit or defined-contribution retirement plans;

-

payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums; and

-

payment of state and local taxes assessed on compensation of employees.

Also covered: Sick leave as compensation (yes), compensation paid via Professional Employer Organizations (yes), and inclusion of independent contractor payments in payroll (no).

'Helter skelter' start to coronavirus small business bailout loans in Iowa - Tyler Jett, Des Moines Register. "Bridge Community Bank CEO Bob Steen could not remember the day of the week. It was only Monday."

The Mount Vernon, Iowa banker is on the front line of the Paycheck Protection Program, the forgivable SBA loan program enacted with the CARES Act:

He and his staff struggled to log on to a computer program for submitting the loan applications. There were also rule changes and other hassles as the federal government tasked banks with distributing the urgently needed funding to the millions of anxious small-business owners across the United States.

"It's just a frenzy," Steen said. "It's first come, first serve. Every customer I got expected their loans to be the first. ... My peers are frustrated. You just feel so helpless."

Related:

Eide Bailly COVID-19 Resource Page

Economic Analysis: A Spreadsheet for the Employee Retention Tax Credit - Martin Sullivan, Tax Notes ($) "While the PPP and ERTC try to maintain the employer-employee relationship, the extremely generous unemployment benefits available until July 31 under the CARES Act work in the opposite direction. In fact, many low- and mid-wage employees who lack employer-provided health insurance will find it monetarily advantageous to be laid off rather than remain on the job."

Forgivable Paycheck Loan Or Tax Credit: You Can’t Claim Both, Which Is Better? Robert Wood, Forbes. "You cannot get both a small business loan under the PPP and also claim a tax credit, so some comparison is needed."

Some States May View Stimulus Checks as Reportable Credits - Aaron Davis, Tax Notes ($). "When asked for comments, the revenue departments in Missouri, Louisiana, and Iowa said they are looking into the situation."

Suggestions Start to Roll In on Partnership CARES Act Fixes - Eric Yauch, Tax Notes ($) "But if a partnership files an AAR that doesn’t result in an imputed underpayment, rules similar to the push-out regime under section 6226 apply, and reviewed-year partners must take into account the adjustments in the year in which they received them and refunds aren’t generally available."

Retirement-Related Provisions of the CARES Act - Roger McEowen, Agricultural Law and Taxation Blog. "The Act amends I.R.C. §401(a)(9) to waive the required minimum distribution rule for calendar year 2020 for an IRA, I.R.C. §401(k) plan I.R.C. §403(b) plan or other defined contribution plan, that is in effect by the end of 2020."

Bill would expand COVID-19 payments for college students, other dependents - Kay Bell, Don't Mess With Taxes.

Answers To Your Most Commonly Asked Questions About Those Tax Stimulus Checks - Kelly Phillips Erb, Forbes. "Is my check taxable? No. This is not taxable income."

Refunds, Offsets & Coronavirus Tax Relief - Barbara Heggie, Procedurally Taxing. "The short answers are: (1) the 'normal' refund will probably be offset to pay down the prior-year tax debt, unless the family succeeds in securing a discretionary 'pass' from the IRS, known as an offset bypass refund; and (2) the economic impact payment will probably still come, so long as there’s no child support arrearage on the books for the family’s taxpayers."

Financially Strained Nonprofits Push for Filing Extensions - Frederic Lee, Tax Notes ($). A lot of 990s and 990-PF filings are due May 15, and the filing extensions announced so far don't apply to them.

Cancel or Reschedule a 2019 Income Tax Return Electronic Payment - Illinois Department of Revenue. "If you scheduled an electronic payment for 2019 income taxes to be paid on or before April 15, 2020, your payment will not automatically be rescheduled to July 15, 2020." Guidance on fixing Illinois payments.

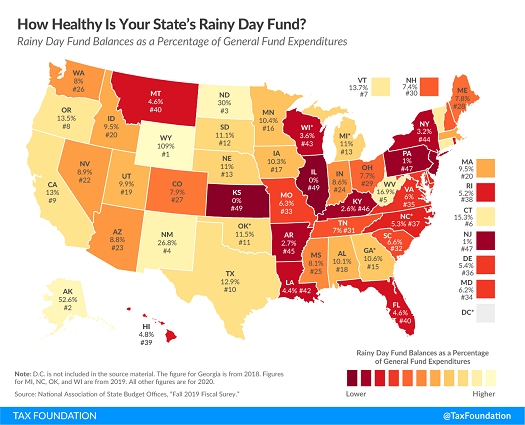

State Rainy Day Funds and the COVID-19 Crisis - Jared Walczak and Janelle Cammenga, Tax Policy Blog. "Two states, Illinois and Kansas, have almost completely empty reserve funds. Another two states, New Jersey and Pennsylvania, both have funds valued at only 1 percent of their general fund expenditures. Similarly alarming is a balance of 3.2 percent of general fund expenditures in New York, given the intensity of the pandemic in that state."

Lewis and Clark depart Fort Mandan - This Day in History, History.com. "The Corps of Discovery had begun its voyage the previous spring, and it arrived at the large Mandan and Minnetaree villages along the upper Missouri River (north of present-day Bismarck, North Dakota) in late October."

Make a habit of sustained success.