Economic Analysis: Embattled Employers Now Must Navigate Multiple Relief Measures - Martin Sullivan, Tax Notes ($).

All the trillions of dollars of tax cuts, loans, and payment postponements enacted by Congress are providing much-needed medicine to counter the macroeconomic shock delivered by the coronavirus pandemic. But the details are numerous and complicated.

That complexity is worrisome. Consider that one month ago about 15 million were employed in restaurants. Out of those millions, 90 percent were with businesses with fewer than 50 employees. With sales revenue either eliminated or significantly reduced, owners of those small businesses must quickly decide about layoffs (over and above existing layoffs).

The article discusses the need to choose between the forgivable loans of the Paycheck Protection Program and the longer-lived benefits of the Employer retention credit.

Paycheck Protection Program - Maybe Next Week - Peter Reilly, Forbes.

It reminds me of a joke about umpires talking about what constitutes a ball or a strike. The final grizzled old umpire says “Somes I calls ball. Somes I calls strikes. They ain’t nuthin till I calls em.”

Effectively your umpire is going to be the bank using the rule book that the SBA has not yet written.

Follow the Eide Bailly Covid-19 page for the latest on the rules as they are updated.

Coronavirus Relief Act Fixes NOL Legislative Quirks - Emily Foster, Tax Notes ($). "Congress modified section 172 to address liquidity issues arising from the coronavirus pandemic by temporarily repealing the 80 percent NOL limitation and allowing deductions for loss carryovers and carrybacks to fully offset taxable income for tax years beginning before January 1, 2021. The new law also allows businesses to carry back 2018-2020 losses for up to five years before the year of the loss."

The bill also fixes the effective dates of the new rules so they are now effective for years beginning after 12/31/17, rather than years ending after that date.

Trump’s Proposal to Prop Up Restaurants Gets Poor Reviews - Jonathan Curry, Tax Notes ($). "President Trump suggested restoring the full deduction for meals and entertainment expenses as a way to keep restaurants in business, but many tax observers say that’s a half-baked choice at best."

IRS Mandates Telework but Remains Open for E-Filing, Refunds - William Hoffman, Tax Notes ($). "'They’re taking e-filings, and if you need a refund, all of that stuff is working,' said Jeffery S. Trinca of the National Association of Enrolled Agents. 'Everything else is now slowed down or closed down.'"

More States defer filing and payment deadlines for 2019 returns. Tax Notes reports that Kansas, Maine, Massachusetts, Mississippi, Nebraska, Michigan, Ohio, Tennessee, Vermont, and West Virginia have joined the list of states delaying filing due dates or payment deadlines as a result of the Covid-19 emergency.

Different states have different dates and returns covered. Updated lists of revised state filing deadlines are available from the AICPA and Bloomberg Tax.

What's in the CARES Act? Part One - Individual Tax Provisions - Kristine Tidgren, The Ag Docket. "The most wide-reaching provision in the law provides “2020 recovery rebates for individuals.” These rebates, which are characterized as credits against 2020 taxable income, will be issued in the amount of $1,200 for “eligible individuals” or $2,400 for “eligible individuals” filing a joint return. In addition, “eligible individuals” will receive $500 for each “qualifying child,” as defined by IRC § 24(c), for purposes of the child tax credit. This generally includes dependent children under the age of 17 for whom the individual has a social security number."

Free File Is An Easy Way For Government To Get Coronavirus Payments To Non-Filers - Howard Gleckman and Elaine Maag, TaxVox. "The new law already calls on the IRS to inform individuals that they could qualify for the rebate and what they need to do to get it. As part of that effort, it could promote the underused and controversial Free File program. It is an easy way for low-income households with internet access to file a return—and become eligible for the payments--without having to leave their homes."

The Stimulus and More - Russ Fox, Taxable Talk. "The IRS announcement on how the payments will be made states that in order to obtain the stimulus payments, you must file a tax return."

Plea for Guidance on Emergency Sick Leave Credit - Bob Rubin, Procedurally Taxing. "Before I beg, I observe that likely it is only people who read this blog, and Service employees, who understand what a burden the FFCRA and the CARES Act place on the Service. The entire federal tax deposit system needs to be redesigned, and at the same time the Service has to be ready to process FFCRA 'accelerated payment requests' within two weeks, while short-staffed and working remotely."

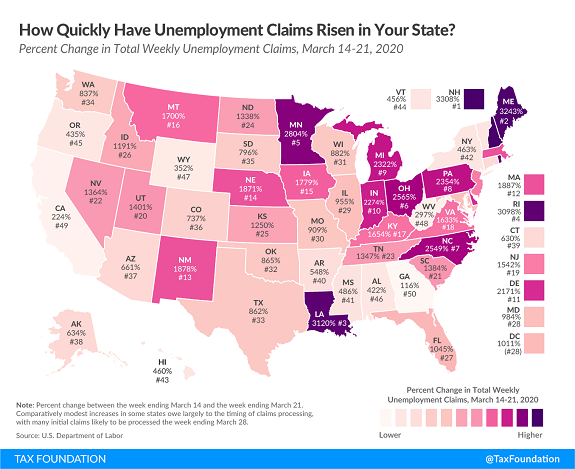

A Visual Guide to Unemployment Benefit Claims - Jared Walczak and Tom VanAntwerp, Tax Policy Blog. "Many states are woefully unprepared for the magnitude of the challenge ahead. Entering the crisis, 21 states’ unemployment compensation trust funds were below the minimum recommended solvency level to weather a recession."

Iowa: + 1779%.

Beware Of Stimulus Check Scams And Related Hoaxes - Kelly Phillips Erb, Forbes. "The Better Business Bureau is already reporting that government imposters are calling about COVID-19 relief. As part of the scam, callers suggest that you might qualify for a special COVID-19 government grant and that it's necessary to first verify your identity and process your request. Variations on the scheme involve contacts through text messages, social media posts, and messages."

Tax, other scammers take advantage of coronavirus fears - Kay Bell, Don't Mess With Taxes. "Some crooks even are using a Facebook variation targeting seniors, telling them about a special grant to help pay medical bills, up to $150,000 in one con attempt. The link leads to a website for the phony U.S. Emergency Grants Federation where all you must do to get the funds is share personal details and pay a small processing fee."

Be careful out there, friends.

Make a habit of sustained success.