Dear Tax Pros,

Shout out to my tax friends out there; we’re the unseen fabric holding it together in times of massive change, like we’re seeing yet again. We just went through this only a few years ago with the Tax Cuts & Jobs Act, the single biggest change affecting taxpayers in 30 years. But our world just exploded yet again, this time in response to unprecedented need.

Not only are we faced with due date nuances and changes to the tax code that will require amended return filings, large portions of the new legislation contain unemployment and loan program changes. And even though many of us tax pros don’t specialize in employment law and financing, we are going to be on the front lines fielding questions and advising our clients how best to navigate these new choices. If you weren’t a generalist before, you may just become one at least in the short term! And if you already are – well, you’re a superhero.

Stay strong friends; you got this!

Cardin, Bipartisan Senate Task Force Secure $377 Billion for Small Businesses – US Senate Committee on Small Business & Entrepreneurship

Provisions Related to Unemployment Compensation in the Senate-Passed CARES Act – House Committee on Ways & Means

Make sure to keep up to date with Eide Bailly's COVID-19 Resource Center!

Will You Get a Rebate Check?

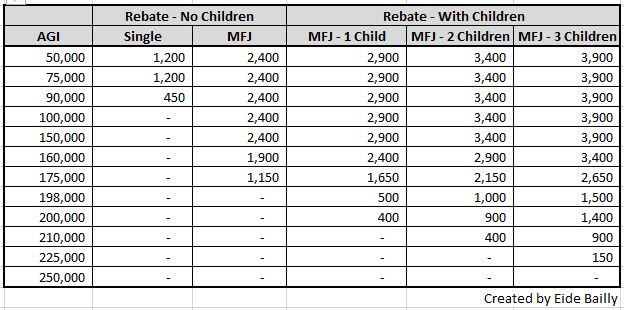

One of the most publicized pieces of the stimulus bill is the individual direct cash payments of $1,200 per adult, plus $500 per child. But like most things, it’s not as simple as that. There are income limitations that kick in depending on your filing status. Here’s a chart below showing the phaseouts of some common scenarios.

How Will The Coronavirus Stimulus Bill’s Individual Payment Work? – Howard Gleckman, TaxVox. “Overall, the Tax Policy Center estimates that about nine in 10 households would get at least some payment. However, not everyone would get the full amount and some people may not get anything at all.”

When You File Your 2019 Tax Return Will Impact Your Stimulus Payment – Tony Nitti, Forbes. “The IRS is going to look first to your 2019 tax return to compute the payment. If no 2019 return has been filed, however, the IRS will grab your 2018 return instead.”

COVID-19 advance tax credit payments: good, bad & ugly – Kay Bell, Don’t Mess With Taxes. “The plan is to start issuing the check as soon as the CARES Act becomes law. So hypothetically the process could start next week. Realistically, though, it could be weeks before checks show up.”

Other COVID-19 Coverage

How Low Income Taxpayers deal with IRS controversies and what it means in the COVID-19 Era – Procedurally Taxing. “Have you ever taken a subway in a foreign country where you don’t speak the language?”

Tracking State Legislative Responses to COVID-19 – Tax Foundation. “Some state legislatures, even those that have already adjourned, will undoubtedly reconvene to further address the pandemic.”

AICPA requests broader relief for taxpayers – Alistair M. Nevius, The Tax Adviser. “The AICPA requested that all federal income tax returns, information returns, and payments (including installments and estimated payments) originally due between March 3, 2020, and July 15, 2020, be granted additional time to file and pay until July 15, 2020.”

Make a habit of sustained success.