What day is it? As we adjust to this new temporary normal in these hopefully brief uncertain times, staying busy for many can be a stress reliever. For the tax world, there’s been no shortage of work as the Federal and State governments roll out relief plans directly impacting taxpayers and pros. In the past 10 days the following has happened:

- Presidentially declared national emergency

- IRS moved the April 15th tax payment deadline

- Tax world revolted and got the April 15th tax filing deadline moved as well

- States continue to evaluate and postpone their tax deadlines

- Families First Coronavirus Response Act signed into law

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act) version 1 released (247 pages)

- Coronavirus Aid, Relief, and Economic Security Act (CARES Act) version 2 released (393 pages)

That, my friends, is an insane amount of activity in a very short window! And there will be more. But these measures are supposed to help Americans. And as tax professionals, we are here to help not only digest and explain this information but use it to guide businesses and individuals through this trying time.

“When I was a boy and I would see scary things in the news, my mother would say to me, “Look for the helpers. You will always find people who are helping.” – (Mister) Fred Rogers

Please know we are here for you, doing what we know how to help.

Keep up to date and find a wealth of information in our COVID-19 resource center.

Senate Releases Updated Economic Relief Plan (CARES Act) for Individuals and Businesses – Tax Foundation. “The CARES Act builds on the two former pieces of legislation by providing more robust support to both individuals and businesses, including changes to tax policy.”

Senate falls far short of votes needed to advance coronavirus bill as clash between Republicans and Democrats Intensifies – Washington Post. “A major sticking point is a $500 billion pool of money for loans and loan guarantees that Republicans want to create, which some Democrats are labeling a “slush fund” because the Treasury Department would have broad discretion over who receives the money. There is little precedent for a program with a similar size and scope.”

Cash in Hand – Will You Get a Check from the Government?

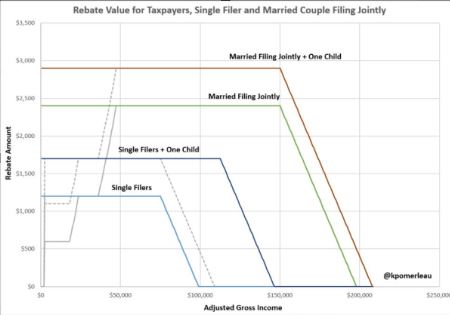

In the CARES Act resides a much talked about direct cash payment to much of the population. It is still changing in form and my not make the final cut but here’s a glance at what it might look like via tax policy expert Kyle Pomerleau.

The most recent payout is graphed in color by taxpayer type, with the greyed-out lines representing the initial version (just days ago):

The major differences in the first and second versions of the rebate are that there’s no longer a phase-in and the payout is based on 2019, if a return has been filed before payout. Both versions contain an income phase-out, which means once your income hits a certain level - no check.

Forbes contributor Tony Nitti explains to us how this all would work, given the facts of the initial version, in his article. The mechanics he walks through will largely be the same as the revised bill, just with slightly different figures. Worth a read to see how it may play out, keeping in mind the final figures are subject to change or may not happen at all.

Helping Out During The Coronavirus Crisis: Where, What & How To Donate – Kelly Phillips Erb, Forbes. “If the tax deduction matters to you, make sure that your donation goes to a qualified charitable organization.”

Coronavirus Relief Bill Could Delay Loan Loss Accounting Rule – Nicola M. White, BloombergTax. “The spread of the coronavirus and the ensuing economic fallout makes it a difficult time for banks to adopt the current expected credit losses (CECL) accounting standard, the groups wrote.”

Related: Bank Capital Buffer Requirements Relaxed in Response to Coronavirus

Lesson From The Tax Court: Last Known Address Rules And The Rule Of Law – Bryan Camp, TaxProf Blog. “Section 6212 requires the IRS to send a Notice of Deficiency (NOD) to a taxpayer’s last known address before it may assess the proposed deficiency…The IRS does not have to prove actual receipt if the IRS has used the taxpayer’s last known address.”

Lawmakers Want Charitable Deduction Available to Non-Itemizers – Fred Stokeld, TaxNotes ($). “The tax break for donating to charity should be made available to more Americans to encourage greater charitable giving during the coronavirus pandemic, according to two House members.”

Taxes’ critical role in times of crisis – Kay Bell, Don’t Mess With Taxes. “Taxes truly are the price of enjoying the type of society we all share.”

Make a habit of sustained success.