Last Friday, Trump announced a national emergency and also instructed the IRS provide relief from tax deadlines for those affected. Does the distinction between national emergency versus a disaster declaration become important for those wondering about potential extension of upcoming tax deadlines? Treasury and the IRS have options to move the filing and payment deadlines under other Internal Revenue Code sections, but when a region is declared a disaster, §7508A comes into play and gives more room. What’s uncertain to some tax pros is if a disaster has been declared nationally or whether states need to request such designation.

While it’s unclear in this moment how Treasury and the IRS will proceed, the AICPA has indicated based on discussions with the two organizations, an announcement may happen this week regarding the March 16 and April 15 deadlines.

To keep track of how states are handling extensions, the AICPA is keeping an up-to-date listing.

What’s In Trump’s National Emergency Announcement on COVID-19? – Charlotte Butash, Lawfare. “Instructs the Department of the Treasury to provide relief from tax deadlines to Americans affected by the COVID-19 emergency.”

House passes coronavirus bill, which includes paid sick leave for workers – Gina Heeb, BusinessInsider. “House Speaker Nancy Pelosi initially announced that a deal had been reached between Democrats and Treasury Secretary Steve Mnuchin on Friday evening. Shortly after, Trump tweeted that he supported the bill, saying he was looking ‘forward to signing the final Bill, ASAP!’”

Late Saturday, Treasury Secretary Mnuchin released a statement in support of the House bill as well, stating:

Employers will be able to use cash deposited with the IRS to pay sick leave wages. Additionally, for businesses that would not have sufficient taxes to draw from, Treasury will use its regulatory authority to make advances to small businesses to cover such costs.

Fiscal Measures during the Coronavirus Outbreak – Cristina Enache, TaxFoundation. “Countries around the world are implementing emergency tax measures to support their debilitated economies under the coronavirus (COVID-19) threat.”

Germany Eases Tax Requirements for Virus-Hit Businesses – Kathy Larsen, BloombergTax. “Enforcement measures and late-payment penalties will be waived until Dec. 31 for companies directly affected by the coronavirus.”

America’s Biggest Banks Suspended Buybacks In Effort to Support Economy Over Their Own Stock Prices – Antoine Gara, Forbes. “The move means that Wall Street is prioritizing supporting the U.S. economy with its cash, instead of using it to engineer stock prices higher after a sharp market drop.”

White House Discussing Allowing Airlines to Keep Ticket Tax – Alan Levin and Seleha Mohsin. “White House officials are discussing temporarily allowing cash-strapped airlines to keep some taxes and fees they collect from passengers as a way to help as travel plummets due to the spread of coronavirus.”

Coronavirus Will Change How We Shop, Travel and Work for Years – Enda Curran, Yahoo!Finance. “’Once effective work-from-home policies are established, they are likely to stick,’ said Karen Harris, managing director of consultancy Bain’s Macro Trends Group in New York.”

8 Tips To Make Working From Home Work For You – Yuki Noguchi, NPR

While social distancing is in full-effect, this article gives some great tips on how to be most effective while our work environments temporarily switch from office to home.

1) Get your technology in order

2) Make sure you have bandwidth

3) The kids are alright – but they’re home too

4) Manage expectations

5) Know thyself (and thy WFH weaknesses)

6) Embrace the webcam

7) Stay connected

8) Do what you can; discuss when you can’t

__________________________________________________________________________________________

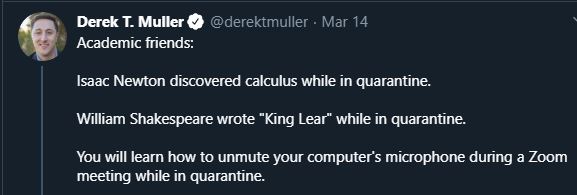

It’s said that Shakespeare wrote some of his greatest works during the plague-inspired quarantine. I have no doubt something good will come from this current state of affairs.

Make a habit of sustained success.