U.S. Treasury Likely to Push Back April 15 Tax Filing Deadline, Sources Say - Kate Davidson, Richard Rubin and Andrew Restuccia, WSJ. This would be huge:

The Trump administration is likely to extend the April 15 tax deadline as part of an effort to mitigate the effects of the novel coronavirus on U.S. households and businesses, according to an administration official and another person familiar with the matter.

Neither the decision to extend the deadline nor the mechanics of how such an extension might work are yet final.

This would be a big deal for gig economy workers and employers facing both income loss from virus shutdowns and a balance due for 2019 taxes.

It would also be a big hairy deal for those of us in the tax prep game.

Lawmakers Rebuff Trump on Payroll-Tax Suspension for Outbreak - Andrew Restuccia, Andrew Duehren and Richard Rubin, WSJ ($).

"President Trump’s push to suspend the payroll tax to boost the economy during the coronavirus outbreak fell flat on Capitol Hill, as lawmakers of both parties said they preferred targeted measures to assist hourly workers and the battered travel industry." Also:Among the other ideas Republicans are discussing, according to a person in the meeting, were expanding a tax credit for family-leave programs that Congress created in 2017; fixing an error in the 2017 law that affects retailers and restaurants; and delaying estimated tax payments.

Expect a lot of long-standing proposals to be rebranded as Coronavirus Emergency Relief.

California Coronavirus tax deposit relief - RIA Checkpoint ($) "The California Employment Development Department (EDD) has announced that employers statewide directly affected by the new coronavirus (COVID-19) may request up to a 60-day extension of time from the EDD to file their state payroll reports and/or deposit payroll taxes without penalty or interest."

Free link to California announcement here.

Congress Asks IRS For Update As Rumors Fly About Extending The Tax Filing Deadline - Kelly Phillips Erb, Forbes. " As of today, the deadline for filing remains April 15, 2020."

Will the April 15th Deadline be Extended?- Russ Fox, Taxable Talk. "I’ll close with something that’s obvious. This week long-time clients called me and said they had colds, and wished to postpone their appointment. We fit them in in two weeks. If you’re sick, use some common sense (be it a cold, the flu, or anything else): Don’t take actions that will infect others!"

Targeted, Industry-Specific Tax Breaks Would Be A Terrible Response To Coronavirus - Howard Gleckman, TaxVox. "A big part of the problem is knowing where to draw the line. Airlines appear to have been hard hit. So have cruise lines. But what about hotels (including Trump’s own properties)? And if hotels get a tax break, what about Airbnb or VBRO hosts? How about the firms that supply food or laundry services to the travel or hospitality industries?"

Shaky Markets Create Tax Opportunities for Estate Planners - Jonathan Curry, Tax Notes ($) How so? Lower values make for smaller gifts. Also: "The low-interest-rate environment is also one that is highly favorable to many estate tax planning techniques."

Coronavirus in the workplace: what you need to know - Thomsen Reuters. "Employers should plan how best to decrease the spread (and impact) of Coronavirus in the workplace in the event of an outbreak.

Obamacare tax forms in the time of coronavirus - Kay Bell, Don't Mess With Taxes. "As for Forms 1095-B and C, the Internal Revenue Service is enforcing the still-on-the-federal-books employer mandate of Obamacare"

What Is a “Trade or Business” For Purposes of Installment Payment of Federal Estate Tax? - Roger McEowen, Agricultural Law and Taxation Blog. "Self-employment tax is not a crucial factor, but passive rental arrangements such as cash rent leases, are not eligible."

Another Plea Related to Offshore Accounts - Jack Townsend, Federal Tax Crimes. "The big twist here is that Butler coupled the offshore evasion [with] failure to file tax returns."

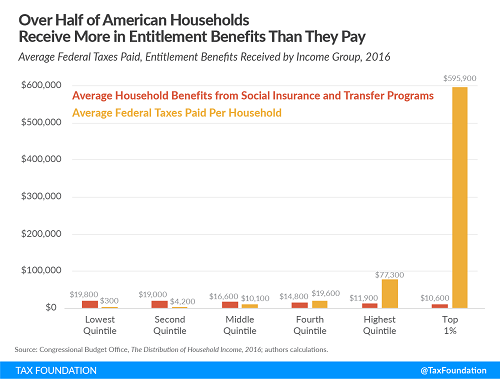

What Would Income Equality Really Look Like? - Scott Hodge, Tax Policy Blog. "But an important question is often left out of this inequality debate: How much is the government already redistributing income through the tax code?"

"The CBO data shows that households in the poorest income group (couples earning less than $32,500) paid an average of $300 in federal taxes and received nearly $20,000 in social insurance and means-tested entitlement benefits."

Analysis of Democratic Presidential Candidate Individual Income Tax Proposals - Erica York and Garrett Watson, Tax Policy Blog. "Changes to individual income tax rates and the individual income tax base are a major component of the major Democratic presidential candidate tax plans. Much of the tax policy debates have centered on repealing elements of the Tax Cuts and Jobs Act (TCJA) of 2017, including reverting the top marginal income tax rate to its pre-TCJA level."

Make a habit of sustained success.