Supreme Court Decision Creates Uncertainty for Tax Refunds - Stephanie Cumings, Tax Notes ($). "The Court held February 25 that the federal common law doctrine known as the Bob Richards rule was invalid and couldn’t be used to settle disputes over tax refunds in bankruptcy."

While battles over tax refunds in consolidated corporate returns are relatively rare, so are Supreme Court decisons on tax issues, so this is worth a little attention.

The case involved a bank that was closed in 2011 by the FDIC. As banks that close lose money, as a rule, tax refunds were there to be had. The question was whether the refunds should go to the bank that lost the money -- and therefore to the FDIC -- or to the bankrupt holding company whose consolidated return included the bank.

The case involved a rule that federal courts have used in allocating tax refunds, called the "Bob Richards Rule." The court opinion explains (footnotes omitted):

As initially conceived, the Bob Richards rule provided that, in the absence of a tax allocation agreement, a refund belongs to the group member responsible for the losses that led to it. With the passage of time, though, Bob Richards evolved. Now, in some jurisdictions, Bob Richards doesn't just supply a stopgap rule for situations when group members lack an allocation agreement. It represents a general rule always to be followed unless the parties' tax allocation agreement unambiguously specifies a different result.

The members of the consolidated return had a tax-sharing agreement, as all consolidated returns should have. Now the case will go back to state courts to determine the status of the refund under that agreement, using state corporation and contract law.

The moral? Tax sharing agreements are important. It's not just bankruptcy; subsidiaries get bought and sold every day, and nobody wants to fight over refunds of sold corporations in court. This ruling eliminates any federal default rule for loss sharing. That makes it essential to get good tax and legal counsel when drafting tax-sharing agreements or doing sale and acquisition due diligence.

More coverage:

Supreme Court Strikes Down ‘Bob Richards Rule’ in Tax Case - Aysha Bagchi, Bloomberg News

Supreme Court rules state law applies to corporate tax refund allocation - Payton Smith, Jurist.org

IRS Allows Some Farmers to Revoke Election out of UNICAP - Kristine Tidgren, The Ag Docket. "On February 21, IRS issued a long-awaited revenue procedure, IRS Rev. Proc. 2020-13, to allow farmers who had elected out of UNICAP prior to the Tax Cuts and Jobs Act to revoke that election if they qualify as a small business taxpayer. Owners of orchards and vineyards, in particular, have been waiting for this revenue procedure since the Tax Cuts and Jobs Act went into effect."

Man Pleads Guilty to Preparing and Filing False Tax Returns and Theft of Government Funds - U.S. Department of Justice.

A Gilmore City, Iowa man pleaded guilty to running a shady tax return prep business. According to court records, the offenses involved Schedule C, the earned income tax credit, and the child tax credit. While the documents provide no further details, it is likely that the Schedule C's involved were prepared to achieve maximum refundable earned income tax credits.

It reminds us that it is unwise to choose a preparer just because they magically generate big refunds. The taxpayers involved will be expected to repay the improper refunds, and the examination rate on that preparer's work will likely be extraordinary.

Scammers Are Sending Fake Tax Forms To Taxpayers Via Email - Kelly Phillips Erb, Forbes. "Here's how it works. The scammers send a letter to a taxpayer stating that they may be exempt from withholding and reporting income tax. However, the letter advises that the taxpayer needs to authenticate their information by filling out and returning a form W-8BEN - only the attached form W-8BEN and accompanying instructions are fakes."

Deducting business meals & other expenses on Schedule C - Kay Bell, Don't Mess With Taxes. "Record keeping obviously is crucial here. Good documentation can ensure you write off a wide range of business expenses."

Section 911 Housing Cost Amounts Updated for 2020 - Andrew Michel LLC. "For example, the limitation on Housing Expenses for 2020 in Beijing, China is $69,000. Therefore, an individual living in Beijing with housing expenses in 2020 of $69,000 or more could exclude from income an amount of $51,784 ($69,000 - [107,600 X 16%])."

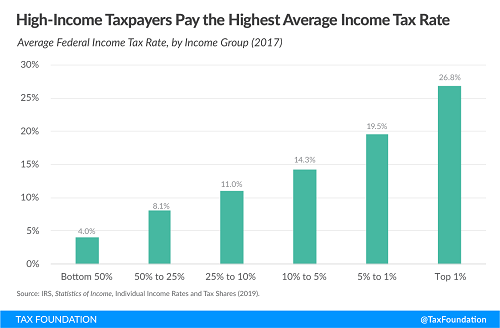

Summary of the Latest Federal Income Tax Data, 2020 Update - Erica York, Tax Policy Blog. "The top 1 percent of taxpayers paid roughly $616 billion, or 38.5 percent of all income taxes, while the bottom 90 percent paid about $479 billion, or 29.9 percent of all income taxes."

Did you know? Tax Analysts posts (for free!) all available returns for Presidents and current presidential candidates. So if you want to wondering how Harry Truman's 1935 1040 came out, your dreams have come true.

Make a habit of sustained success.