Biden's Treasury pick will have lengthy to-do list on taxes – Naomi Jagoda, The Hill. “Coronavirus relief will be a top priority for Biden's economic team early next year, and tax provisions are likely to be a component of any stimulus package. Yellen would also play a key role in crafting regulations implementing tax laws, IRS funding and House Democrats' push for President Trump's tax returns.”

Trump’s Payroll-Tax Deferral Creates Predicament for Congress – Richard Rubin, WSJ($). “President Trump’s decision to defer payroll taxes until the end of the year is leaving challenges for lawmakers to manage after he leaves office in January, and they haven’t figured out what—if anything—to do.”

“Members of Congress in both parties weren’t keen on the August executive action, which let employers stop collecting the 6.2% Social Security payroll tax from many workers in the final four months of 2020. The move was meant as a form of relief during the economic slump caused by the coronavirus pandemic, but few employers stopped withholding.

That created a predicament for Congress. Employees whose payroll taxes temporarily shrank will face double withholding starting in January, which could pinch households that haven’t planned for it.”

Minnesota House Republicans Announce Tax Relief for Businesses – Carolina Vargas, Tax Notes. “ Minnesota House Republicans have announced a coronavirus relief package that includes sales tax and license fee relief for businesses whose operations were limited or closed by the recent shutdown.”

“The package, titled the Main Street Relief Act, would also establish a $400 million grant program for businesses affected by the most recent executive orders of Gov. Tim Walz (DFL). The program would be administered through the counties, according to a November 24 release.

The proposal would provide a three-month sales tax holiday for businesses that have been takeout- or curbside-only because of the executive orders, as well as a three-month sales tax holiday that would begin upon the reopening of businesses that were ordered to be completely closed.

It would allow breweries to sell their products in containers up to 64 ounces and would double the cap for the sales of takeout liquor, wine, and beer. The state fee for businesses that sell alcohol between 1 a.m. and 2 a.m. would be waived.”

Did the PPP Increase Jobs? – Martin Sullivan, Tax Notes($). “The employment gains attributable to the Paycheck Protection Program have been modest relative to the huge outlay of government funds, according to different teams of economists using varied statistical techniques on large data sets from private sector sources.”

Like-kind exchange rules define real property, incidental personal property – Sally P. Schreiber, J.D., Journal of Accountancy. “The IRS has issued final regulations that define what property qualifies for Sec. 1031 like-kind exchange treatment (T.D. 9935). The new rules are necessary because the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97, removed personal property from qualifying for the deferred tax treatment for like-kind exchanges. T.D. 9935 finalizes proposed regulations (REG-117589-18) issued in June.”

IRS Reduces Future Required Minimum Distributions Just A Little – Bob Carlson, Forbes. “The IRS recently issued proposed regulations that will reduce required minimum distributions (RMDs) on IRAs, other qualified retirement plans, and annuities.”

Teaching Tax During a Pandemic Is No Easy Task – Jonathan Curry, Tax Notes. “Tax law and accounting professors faced daunting challenges getting up to speed on a whole new way of teaching thanks to the coronavirus, but they’re already discovering new techniques that could persist for years to come.”

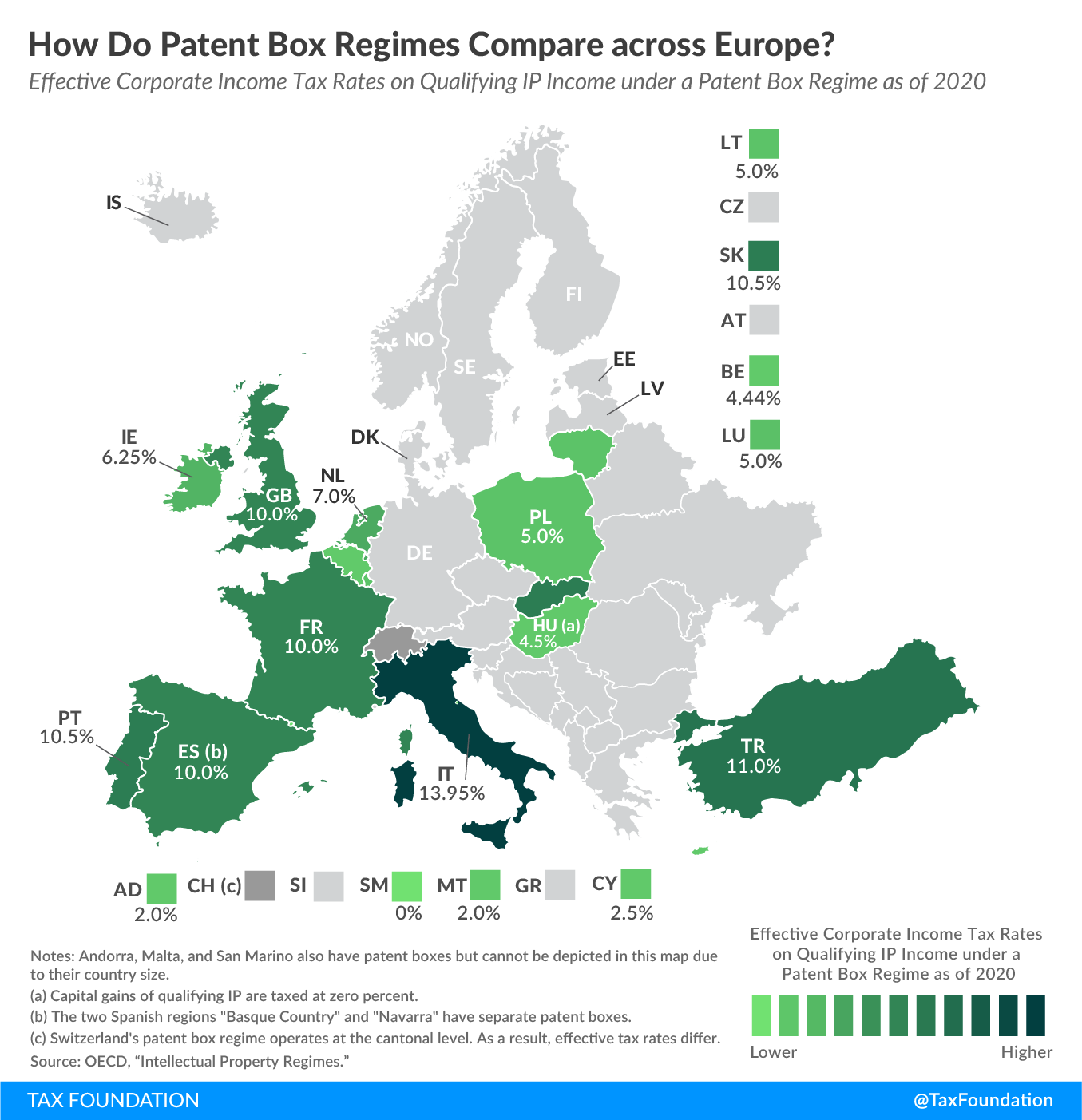

Patent Box Regimes in Europe – Elke Asen & Daniel Bunn, Tax Policy Blog. “The aim of patent boxes is generally to encourage and attract local research and development (R&D), incentivizing businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.”

Negative Reviews for Scented Candles Rise Along with COVID-19 Cases – Loukia Papadopoulos, Interesting Engineering. “It seems that the negative reviews of Amazon's three best selling scented candles have increased along with COVID-19 cases. This correlation could of course be associated with the fact that the virus causes a loss of senses including smell.”

Make a habit of sustained success.