IRS Guidance Nixes 2020 Expense Deductions for PPP Loans Forgiven in 2021 - Eide Bailly Tax News & Views. "The IRS last night released guidance disallowing 2020 deductions for expenses that will give rise to forgiveness of Paycheck Protection Program loans - even if the forgiveness isn't applied for and confirmed until 2021."

Taxpayers who do not get forgiveness will have the ability to deduct the expenses in either 2020 or 2021.

IRS Drops Another Hammer on PPP-Funded Deduction - Eric Yauch, Tax Notes

The IRS has confirmed practitioners’ fears and clarified that if expenses are funded with a Paycheck Protection Program loan that hasn’t yet been forgiven, that doesn’t mean they can take the deductions this year.

“If a business reasonably believes that a PPP loan will be forgiven in the future, expenses related to the loan are not deductible, whether the business has filed for forgiveness or not. Therefore, we encourage businesses to file for forgiveness as soon as possible,” said a Treasury statement.

IRS Says No 2020 Deduction if PPP Forgiveness Reasonably Expected in 2021 - Kristine Tidgren, Ag Docket. "Although it will not be popular, this guidance alerts taxpayers to the IRS position on this important subject prior to the calendar year end."

Telecommuting Workers in Refuge States Complicate State Taxes - Iris Chung, Eide Bailly. Excellent coverage of a big 2020 issue:

Because states typically source employee income based on where the service or employment is performed, remote workers may be creating a significant new state tax footprint, which will require them to file and pay taxes as nonresidents or statutory residents. This is in addition to complying with tax obligations of their state of residence. And, states will need to adjust to these changes beyond 2020, as long as remote workers continue to live and work in a refuge state, a term used to describe a location outside the state of residency or employment.

Also:

Most states do not have physical presence thresholds, like a minimum number of days before an individual is required to file and pay taxes. The Mobile Workforce State Income Tax Simplification Act of 2020 (H.R. 5674) has been reintroduced to the U.S. House of Representatives. This legislation would create a uniform nexus threshold by limiting the state taxation of non-resident workers to those that have performed services in the state for more than 30 days.

However, this bipartisan bill is unlikely to move forward in the near future.

Much more at the link.

Tax Court (Judge Lauber) Issues Significant Transfer Pricing Decision in Coca-Cola; Burden of Proof Issues - Jack Townsend, Federal Tax Procedure. "I do ask that readers keep in mind that transfer pricing cases are, at bottom, simply valuation cases."

Tax Court Sides With IRS in Coca-Cola Transfer Pricing Case - Ryan Finley, Tax Notes ($):

The Tax Court’s November 18 decision in The Coca-Cola Co. v. Commissioner upheld all of the IRS’s primary transfer pricing adjustments, which totaled more than $9 billion, and agreed with the company only on the issue of whether those adjustments should be reduced to account for $1.8 billion in dividend payments. The primary adjustments resulted in over $3 billion in deficiencies, interest, and penalties asserted by the IRS.

The dispute primarily concerns the relative reliability of the transfer pricing methods selected by the parties in pricing Coca-Cola’s license of trademarks, product formulas, and other intangibles to its affiliated foreign “supply points.”

Didn't get COVID-19 stimulus money? Nov. 21 is the last day to register for it - Kay Bell, Don't Mess With Taxes:

If you didn't get a COVID-19 economic relief payment or didn't get all to which you were entitled, you can still apply for the financial help this year.

But act soon. Really soon.

The deadline to let the Internal Revenue Service know you're due some of the relief money is 3 p.m. this coming Saturday, Nov. 21.

Coalition Objects to PPP Loan Questionnaire - Nathan Richman, Tax Notes ($). "The organizations emphasized that they don’t oppose any inquiry into whether PPP loans should be forgiven. But they think the information their members will be asked to provide won’t appropriately balance administrative burden or the possibility of subjective variances in the agency analyses between companies, according to the letter."

Employers Face Delays in Quarterly Tax Return Refunds - Frederic Lee, Tax Notes ($). "Employers are experiencing delays in tax refunds issued for Forms 941, “Employer’s Quarterly Federal Tax Return,” this year regardless of whether the forms were electronically filed, according to multiple practitioners."

CARES Act’s ‘Golden Opportunity’ Could Set Up Headaches Later - Jonathan Curry, Tax Notes. "A coronavirus relief provision allowing early distributions from retirement plans offers upfront relief now, but it could be a pain to administer in the years to come."

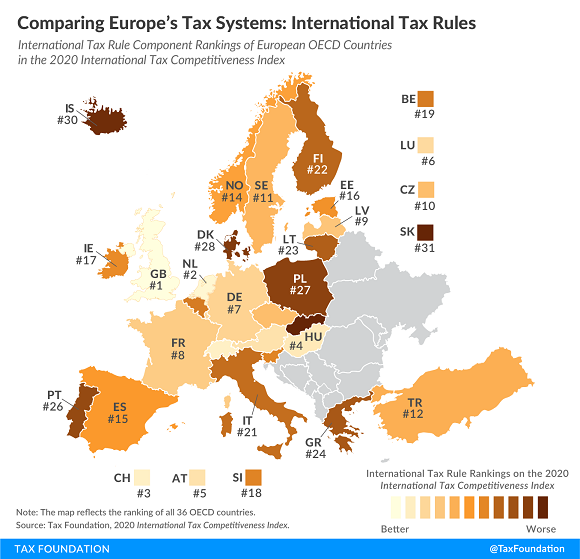

Comparing Europe’s Tax Systems: International Tax Rules - Elke Asen, Tax Policy Blog. "Today’s map looks at how European OECD countries rank on international tax rules and is the last in our series examining each of the five components of our 2020 International Tax Competitiveness Index (ITCI)."

When It Takes the IRS 5+ Months to Process an Amended Return… Russ Fox, Taxable Talk:

Back in May, clients of mine discovered they left something out of their 2018 tax return. We prepared an amended return, the clients included a check for the additional tax, and it was mailed off to Kansas City. The check was cashed in July, so the amended return was received.

Fast forward to today. The amended return still has not been processed (and no one knows when it will be; it’s almost certainly sitting in a bin with thousands of other amended returns), but the IRS Automated Underreporting Unit discovered the error and sent the clients a notice. They found the same error. So now my clients have to respond to this notice, telling the IRS there’s an amended return somewhere in Kansas City.

The IRS should stop issuing notices until it catches up on its backlog. It's scaring taxpayers with a lot of notices that shouldn't be issued.

Restaurants Found to Meet Significant Participation Activity Test, Taxpayer Materially Participated and Could Deduct Losses - Ed Zollars, Current Federal Tax Developments. "At first glance some of the facts of this case make it look a lot like many of the cases that have proven to be easy victories for the IRS in the Tax Court."

A deep dive into the case we discussed here Tuesday.

When Does an Innocent Spouse Request Stop a Levy - Keith Fogg, Procedurally Taxing. "The court decides that the language stopping collection resulting from the filing of an innocent spouse request does not stop the bank levy during the 21-day period."

Why Do States Tax Illegal Drugs? - Nikhita Airi and Aravind Boddupalli, TaxVox. "Given the little revenue illegal drug taxes raise, the resources they require to administer, and the inequitable and harmful impacts they enable through enforcement, it is hard to justify drug stamp taxes as good tax policy."

No ‘Stealth Tax Hike’ in 2021, but Individual and Business Tax Increases Loom - Garrett Watson, Tax Policy Blog. "While there are many tax changes built into the tax code over the coming years for individuals and businesses, the recent claim that lower- and middle-income Americans may see a “stealth tax increase” in 2021 due to the Tax Cuts and Jobs Act (TCJA) is untrue."

400 years ago today, Pilgrims aboard the Mayflower sighted Cape Cod. In case you feel bad about your Thanksgiving trip:

I will miss seeing my out-of-town family this year, but it could be worse. I have a fishing rod.Plymouth faced many difficulties during its first winter, the most notable being the risk of starvation and the lack of suitable shelter. The Pilgrims had no way of knowing that the ground would be frozen by the middle of November, making it impossible to do any planting. Nor were they prepared for the snow storms that would make the countryside impassable without snowshoes. And in their haste to leave, they did not think to bring any fishing rods.

Make a habit of sustained success.