Rettig to Tax Pros: Blanket Penalty Relief ‘Not Going to Happen’ - William Hoffman, Tax Notes. "Rettig’s statement was a direct hit to the AICPA’s efforts — stretching back as far as July — to get penalty relief for taxpayers and practitioners who claimed that the coronavirus pandemic interfered with their ability to timely file returns or make payments before various IRS deadlines."

Quandaries for M&A Deals Involving PPP Borrowers Eased - Emily Foster, Tax Notes. "The IRS has provided long-awaited guidance clarifying businesses’ eligibility for the employee retention tax credit when they acquire target entities that have received a Paycheck Protection Program loan."

Related: Recently Released PPP Loan Forgiveness Updates

Nov. 21 deadline nears to register online for Economic Impact Payment; Some people can claim special credit next tax filing season - IRS. "The only way remaining to get a payment in 2020 is to register using the Non-Filers: Enter Info Here tool on IRS.gov before the Saturday deadline."

This is for those who missed out on the COVID relief payments earlier this year. Congress has not authorized a second round of payments.

IRS Ramping Up Focus on Partnership Exams - Kristen Parillo, Tax Notes ($). "The focus will not only be on partnerships, but also on investor returns related to passthrough entities, said De Lon Harris, deputy commissioner for examinations, IRS Small Business/Self-Employed Division."

IRS allows more truncated tax ID numbers - Kay Bell, Don't Mess With Taxes. " This summer, the IRS finalized rules that now allow employers to truncate their employees' Social Security numbers (SSNs) on W-2 forms sent to workers next year."

Taxpayer Hit With Late Filing Penalty When Accounting Firm Submits Return Seconds After the Filing Deadline - Ed Zollars, Current Federal Tax Developments. "This was true even though the CPA submitted the return seconds after the clock ticked past midnight on October 15, 2013."

This is the same taxpayer featured in yesterday's post about passive losses and constructive dividends.

Fourth Circuit Holds that a Reckless Failure to File an FBAR Is Subject to the Civil Willful FBAR Penalty and Such Penalty is Not Capped by Outdated Regulations - Chaim Gordon. "Anyone who is required to but fails to file an FBAR is subject to a maximum civil penalty of not more than $10,000 or, if the person’s failure to file was 'willful,' to a maximum civil penalty of the greater of $100,000 or 50% of the balance in the account at the time of the violation."

Can You Go To Jail for Failing to Disclose Virtual Currency on a Tax Return or as Part of an Offer for a Collection Alternative?- Matthew Roberts, Freeman Law. "With the IRS’ increased focus on cryptocurrency, taxpayers should be aware that statements made on a tax return and/or collection-type forms may be used against them in a criminal prosecution. Accordingly, taxpayers should be careful in answering any and all virtual cryptocurrency questions on these forms."

New Jersey Lawmakers Pass Bill to Mitigate Unemployment Tax Increase - Lauren Loricchio, Tax Notes. "The New Jersey State Legislature has passed a bill that would reduce the amount of unemployment insurance taxes employers owe and delay an increase in the unemployment trust fund reserve ratio to help businesses deal with the economic impact of the COVID-19 pandemic."

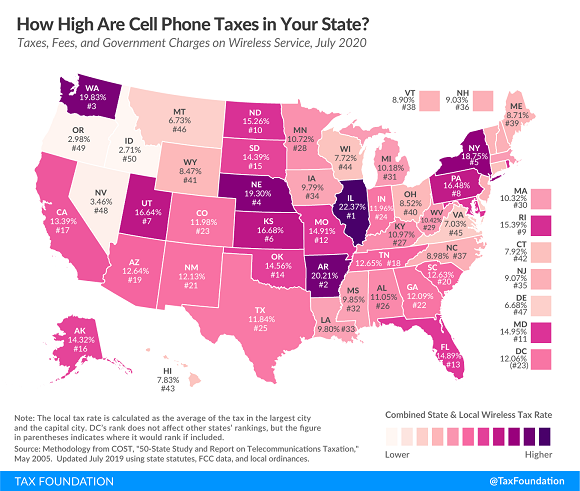

Wireless Tax Burden Remains High Due to Federal Surcharge Increase - Scott Mackey and Ulrik Boesen, Tax Policy Blog. "A typical American household with four phones on a “family share” plan, paying $100 per month for taxable wireless service, can expect to pay about $270 per year in taxes, fees, and surcharges—up from $260 in 2019."

Biden Proposed Raising Social Security Payroll Taxes By $740 Billion…And Still Got Elected President - Howard Gleckman, TaxVox. "It also is worth noting that the president-elect’s plan won’t make the Social Security system solvent, a standard promise of many past reform plans. The Urban Institute estimates that by increasing benefits even as he raises taxes, Biden would delay Social Security insolvency by only about five years."

What Will Happen to FAQs? - Marie Sapirie, Tax Notes Opinions. "But sometimes FAQs stand alone as the only guidance the IRS issues on critically important topics. Following the UBS scandal in 2008, the OVDP in 2009 and the offshore voluntary disclosure initiative in 2011 relied on FAQs as their sole form of written guidance. Changes to the FAQs frequently caused consternation, for example, when the IRS updated an answer to remove an explanation of its reasoning."

Project Veritas and Illegality - Sam Brunson, Surly Subgroup. "It means that, if Project Veritas in fact broke the law as it helped and encouraged Hopkins’s perjury, it does not meet the common law requirements for tax exemption."

Today in history: Tone dialing telephones are introduced, November 18, 1963. "Engineers tested 15 different keypad layouts before settling on the modern configuration with 1 at the top left and 0 in the bottom row. The # and * keys were added to possibly be used to access computers through telephone lines."

Computers through phones. Imagine that.

Make a habit of sustained success.