Danger Ahead? IRS Greenlights Passthrough Workaround to SALT Cap - Amy Hamilton, Tax Notes ($):

The issue is whether states will treat entity-level taxes as creditable for purposes of their resident income taxes. Blue states could be pitted against red states — or there could be a race to the bottom until every passthrough is a corporation for state tax purposes.

“Are taxpayers going to have to fight the Wynne case all over again, with a Court whose membership may be more skeptical of dormant commerce clause jurisprudence?” Wlodychak asked. “Unless we get resident state tax relief to these questions, passthrough owners are just trading a 36 percent federal tax benefit for a $1-for-$1 state tax increase in their home states.”

I expect this to be a big issue in upcoming state legislative sessions.

SALT Cap Workarounds May Catch On in More States After IRS OK - Sam McQuillan, Bloomberg Tax. "More states are expected to pass laws letting businesses avoid the limit on personal tax deductions for state and local taxes, following IRS guidance approving the workaround."

IRS Signals Approval of Entity-Level SALT Cap Workaround, But States Should Still Think Twice - Jared Walczak, Tax Policy Blog. "Such provisions, moreover, treat pass-through business owners more favorably than other earners, and it is not immediately clear why an investor in an S corporation, or a member of a partnership, should receive preferential treatment compared to someone who earns her income through wages instead."

Biden Tax Credit Proposals Could Gain Traction in Split Congress - Kaustuv Basu, Bloomberg. "A Democratic president-elect and rising economic pressure on the working class are buoying hopes that family-focused tax credits could be expanded by the next Congress, no matter who ends up in control of the Senate."

Practitioners Push for Clarity on Like-Kind Exchange Extensions - Kristen A. Parillo, Tax Notes. "Providing clarity now will help minimize the confusion taxpayers faced this year when it was unclear whether the longer extension authorized by Rev. Proc. 2018-58, 2018-50 IRB 990, for completing section 1031 like-kind exchange transactions, trumped the general coronavirus relief granted in Notice 2020-23, 2020-18 IRB 742."

NOL Adjustments No Alternative for Bonus Depreciation Changes - Nathan J. Richman, Tax Notes ($). "Taxpayers with net operating losses still need to file returns to change their bonus depreciation tax accounting methods and can’t just adjust their NOLs."

IRS Benefit Plan Exams Take Aim at Participant Loans - Frederic Lee, Tax Notes ($):

Examining section 403(b) plans, section 457(b) plans, and employee stock ownership plans is also part of the IRS’s compliance strategy for the fiscal year, said Catherine Jones, director (employee plans), IRS Tax-Exempt and Government Entities Division, during a November 10 webinar hosted by the American Institute of CPAs.

In basic terms, in order to make a loan from an employee plan, the plan document must spell out that it allows them, said Jones, calling it a “very, very high noncompliant area.”

Also: "'We continue to see problems' with ESOPs, Jones said."

Court Orders Enforcement of IRS Summons to Coinbase - Tax Notes ($). "A U.S. district court, adopting a magistrate judge’s report and recommendation, denied an individual’s petition to quash and ordered the enforcement of an IRS summons issued to Coinbase Inc. in its investigation of whether an individual correctly reported his cryptocurrency transactions."

Related: New Tax Guidance Issued on Cryptocurrency Transactions.

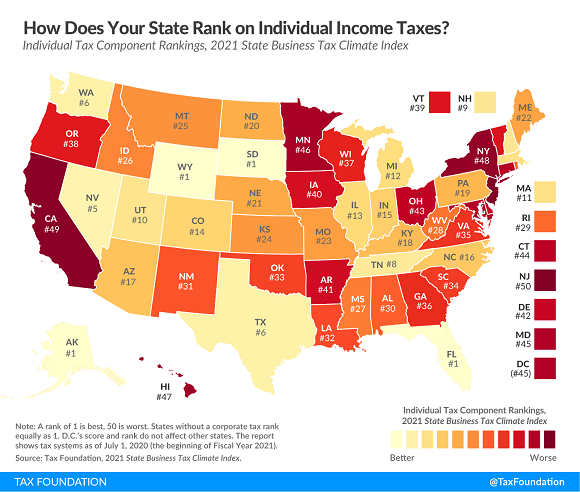

Ranking Individual Income Taxes on the 2021 State Business Tax Climate Index - Janelle Cammenga, Tax Policy Blog. "States that score well on the Index’s individual income tax component usually have a flat, low-rate income tax with few deductions and exemptions. They also tend to protect married taxpayers from being taxed more heavily when filing jointly than they would be when filing as two single individuals. In addition, states perform better on the Index’s individual income tax component if they index their brackets, deductions, and exemptions for inflation, which avoids unlegislated tax increases."

IDR Issues New Income Withholding Tax Tables for 2021 - Iowa Department of Revenue. "For individuals, this means that employers will be reducing the amount of Iowa tax withheld from employees’ paychecks, beginning January 1, 2021, increasing take-home wages for individuals."

Honoring veterans with help beyond Nov. 11 ceremonies - Kay Bell, Don't Mess With Taxes. "Taxpayers who itemize can claim their donations to Internal Revenue Service qualified 501 (c) (3) groups as a tax deduction on Schedule A."

Is it a Farm Lease Or Not? – And Why it Might Matter - Roger McEowen, Agricultural Law and Taxation Blog. "It is important that parties to a farming arrangement clearly understand the legal nature of the relationship and the legal implications that flow from that relationship."

Sorry, Larry Kudlow: Raising Taxes in a Recession Can Make Sense - Joseph J. Thorndike, Tax Notes Opinions. "...an argument that Keynes would find familiar: Rich people spend less (and save more) than poor people."

Update on Brockman Indictment - Jack Townsend, Federal Tax Crimes. An update on the multi-billion dollar indictment of a Texas software executive.

Today in History: Tim Berners-Lee publishes WorldWideWeb: Proposal for a HyperText Project, 30 years ago today. "The current incompatibilities of the platforms and tools make it impossible to access existing information through a common interface, leading to waste of time, frustration and obsolete answers to simple data lookup. There is a potential large benefit from the integration of a variety of systems in a way which allows a user to follow links pointing from one piece of information to another one. This forming of a web of information nodes rather than a hierarchical tree or an ordered list is the basic concept behind HyperText."

You're soaking in it!

Make a habit of sustained success.