Smaller COVID Relief More Likely as Dems Underperform in Election - Alexis Gravely, Tax Notes:

Mel Schwarz of Eide Bailly LLP agreed that a smaller relief package is more likely, especially if Democratic candidate Joe Biden retains his lead in the Electoral College and wins the presidency.

“If, in fact, it does appear that Biden has won and that there is not a route through the courts to overturn that, then I would expect that McConnell′s concerns are now less with [President] Trump and more with his members,” Schwarz said. “And he's got a lot of members who don′t want to spend a lot of money on another COVID package.”

Related:Post-Election Legislative Update webinar. Presented November 11 by Mel Schwarz, Eide Bailly Director of Legislative Affairs.

PPP Deductibility Backer Cornyn Survives Challenge - Jad Chamseddine, Tax Notes. "Texas Republican Sen. John Cornyn’s call to allow a deduction for Paycheck Protection Program loan expenses may fall on friendlier ears under a new administration."

2020 Tax Woes Likely to Haunt Tax Practitioners Into Next Year - Jonathan Curry, Tax Notes:

Self-employed taxpayers who took advantage of relief like the Coronavirus Aid, Relief, and Economic Security Act’s (P.L. 116-136) deferral of the employer share of payroll taxes or the paid sick or family leave provisions in the Families First Coronavirus Response Act (P.L. 116-27) will have to deal with those provisions on their returns for tax year 2020 when they file next year, Annette Nellen of San Jose State University said. “Obviously, they’ve got some things to deal with,” she added.

The IRS will likely have to come up with guidance for taxpayers looking to claim some of the coronavirus relief tax benefits late, according to Nellen. For example, employers that kept employees on the payroll but didn’t actually pay their employees might realize that they should have been paying their employees sick leave, for which they could’ve received reimbursement. “I think those kinds of cases will linger,” she said.

Sounds fun.

Illinois Rejects Graduated Income Tax Proposal - Erin Ailworth, Wall Street Journal ($). "Carol Spain, a director at S&P Global Ratings, said the agency is watching to see how Illinois will address its budget issues, whether by raising its flat tax, expanding its sales tax base, or making budget cuts."

IRS Warns On New Scam Related To Stimulus Checks - Kelly Phillips Erb, Forbes. "As part of the scam, thieves are texting messages to taxpayer. The message looks something like this: You have received a direct deposit of $1,200 from COVID-19 TREAS FUND. Further action is required to accept this payment into your account. Continue here to accept this payment …"

Medical tax matters affected by inflation in 2021 - Kay Bell, Don't Mess With Taxes. "For the 2021 tax year, you can put up to $2,750 in your FSA. That's the same as the 2020 tax year limit. If, however, your employer allows you to roll over unused FSA money into the next benefits year, then the IRS says you get a $50 inflation bump in 2021. The maximum FSA carryover amount goes to $550."

Where There is a Will, There is a Way: Economic Impact Payments for Victims of Domestic Violence and Abuse – Part I - Nina Olson, Procedurally Taxing. The retired Taxpayer Advocate discusses getting economic impact payments to abuse victims.

IRS Mailing Erroneous CP259F Notices - Russ Fox, Taxable Talk. "I do want to point out that this issue shows why using certified mail is essential when sending anything to a tax agency. While I’m hopeful that the trust return is sitting in the trailer and will eventually be filed, it’s inevitable that something is going to get lost."

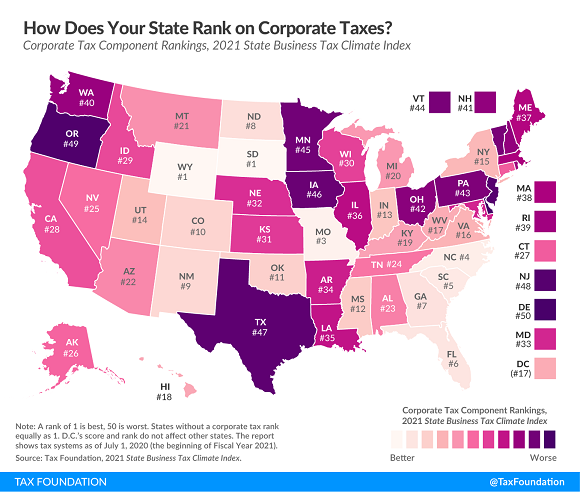

Ranking Corporate Income Taxes on the 2021 State Business Tax Climate Index - Janelle Cammenga, Tax Policy Blog. "Unlike other studies that look solely at tax burdens, the Index measures how well or poorly each state structures its tax system. It is concerned with the how, not the how much, of state revenue, because there are better and worse ways to levy taxes. Our corporate tax component, for example, scores states not just on their corporate tax rates and brackets, but also on how they handle net operating losses, whether they levy gross receipts-style taxes (which are more economically harmful than corporate income taxes), whether businesses can fully expense purchases of machinery and equipment, and whether states index their brackets for inflation, among other factors."

Eide Bailly states rank from #1 to #47. Iowa ranks #46.

Global Markets Webinar. "Eide Bailly Financial Services invites you to join us for a webinar presentation by Jeffrey Kleintop, Senior Vice President and Chief Global Investment Strategist at Charles Schwab & Co. During this webinar, Jeffrey will discuss key topics surrounding the Global Market Outlook."

Driving school instructor's recordkeeping gets a 1-star rating in Tax Court. The owner of a Maryland driving school might want to park at a bookkeeping course after having a bad day in Tax Court yesterday. The taxpayer signed up students and received payments through Stripe, a third-party online contractor. Tax Court Judge Greaves picks up the story [taxpayer name omitted]:

During the year in issue some of Taxpayer's customers were dissatisfied with his service, and, to an extent we cannot quantify, he made cash refunds to them outside of Stripe's payment system. Stripe issued a 2015 Form 1099-K, Payment Card and Third Party Network Transactions, to Taxpayer that reported payments totaling $29,295; however, petitioners first saw the Form 1099-K after filing the petition in this case.

This is the first case I have noticed triggered by 1099-K. IRS instructions explain:

A payment settlement entity (PSE) must file Form 1099-K, Payment Card and Third Party Network Transactions, for payments made in settlement of reportable payment transactions for each calendar year. A PSE makes a payment in settlement of a reportable payment transaction, that is, any payment card or third party network transaction, if the PSE submits the instruction to transfer funds to the account of the participating payee to settle the reportable payment transaction.

In English, that means Ebay, Amazon, or any other bank or third party provider that provides payment settlement services has to file an information report with the IRS.

The IRS noticed that the driving instructor's returns didn't match up with the 1099-K, and things ended up in Tax Court. Judge Greaves:

Petitioners do not dispute that Taxpayer received the money reported on the Form 1099-K but contend that the driving school's gross receipts should be reduced by unreported cash refunds that Taxpayer paid to customers.

Here the taxpayer ran into a snag:

Taxpayer could not produce any receipts, bank account statements, or other financial records of any kind relating to the business to support his claimed refunds, even though he remained under a clear obligation to do so. The only record of the refunds that Taxpayer introduced into evidence was a single document entitled Istar Driving School: Annual Summary Income Tracking Sheet (tracking sheet). This vague and uncorroborated tracking sheet, together with Taxpayer's testimony, are not, however, “sufficient records”. The tracking sheet does not indicate what year it relates to, and petitioners did not testify as to when it was prepared. Taxpayer testified that he found the tracking sheet only a few days before trial.

So on to Plan B:

Taxpayer also introduced Yelp reviews, including one from a customer dated December 17, 2015, which stated that Taxpayer “said that he was going to refund the money and we are still waiting for this”. The Yelp reviews offer little support that Taxpayer actually issued all of the claimed refunds. We therefore conclude that petitioners failed to satisfy their burden, and we sustain respondent's redetermination.

Decision for IRS, with a 20% penalty.

The moral? Good records help more in an IRS exam than bad Yelp reviews.

Cite: T.C. Summ. Op. 2020-27

The stars align. Today is both National Doughnut Day and National Men Make Dinner Day. What could go wrong?

Make a habit of sustained success.