Today is election day. If you are one of the dozens of people nationwide still pondering your choice, here are some tax-related resources for your consideration:

Tax Policy Center: An Analysis of Former Vice President Biden’s Tax Proposals and Donald Trump’s Bullet Point Tax Agenda.

Tax Foundation: Details and Analysis of Democratic Presidential Nominee Joe Biden’s Tax Plan.

American Enterprise Institute: An analysis of Joe Biden’s tax proposals.

Wall Street Journal: How Joe Biden’s Tax Plan Could Affect You.

There are also important state tax votes today. The Tax Policy Blog has coverage that will be updated with results at State and Local Tax Ballot Measures to Watch on Election Day 2020. TaxVox has Big Tax Hikes and Lots of Sin: Your Guide to 2020’s State Ballot Measures.

Tomorrow, when maybe we have some idea of the results, come right back here and we will try to sort things out.

Tax Extenders Face Uphill Battle to Passage - Alexis Gravely, Tax Notes ($):

“Yes, there are some important things in the extender list, but it's not the same kind of must-pass legislation that either the R&D credit or the individual [alternative minimum tax credit] fix was in the past,” Mel Schwarz of Eide Bailly LLP told Tax Notes.

And because Congress previously allowed the provisions to lapse and later extended them retroactively, some members may not view them as particularly urgent.

“I would be less optimistic about the situation this year and the ability to get this done in a lame-duck session than perhaps would have been the case in earlier years,” Schwarz said.

33 provisions are set to expire, including energy tax incentives, the Work Opportunity Credit, and a tax cut for craft brewers.

M&A Dealmakers Tackle COVID and Tax Policy Uncertainties - Emily Foster, Tax Notes. "To address the uncertainties fueled by the possibility of substantial changes in tax policy, dealmakers are using mechanisms that have become more prominent in a pandemic-stricken world, such as earnouts and equity rollovers, according to M&A practitioners."

Five Things That Could Change for CFOs After the Nov. 3 Elections - Wall Street Journal. "Democratic presidential candidate Joe Biden proposes raising the corporate tax rate to 28%, alongside other measures such as an alternative minimum tax of 15% on businesses generating a profit of $100 million or more. He also seeks to raise tax rates on income earned by foreign subsidiaries of U.S. businesses."

Biden’s Tax Increase On Death That No One Is Talking About - Robert W. Wood, Forbes. "Biden's plan could leave you paying higher income taxes after a death by repealing present law’s step-up in basis that increases the tax basis for inherited assets to their full fair market value upon death."

How the 2020 Elections Could Affect State and Local Tax Policy - Scott Roberti, Rebecca Bertothy, and David Sawyer, Tax Notes. "To date, most states have not acted aggressively to address current and looming budget shortfalls caused by the pandemic. Instead, they have been drawing from rainy day funds and hoping for additional federal intervention. However, if federal fiscal relief does not materialize and strains on state finances intensify, states will be forced to act."

Preparing Your Books for Year-End - Jillian Robison, Eide Bailly. "Preparing your accounting records for year-end will ensure you put your best foot forward in the new year, but it will also help you close out last year without a headache."

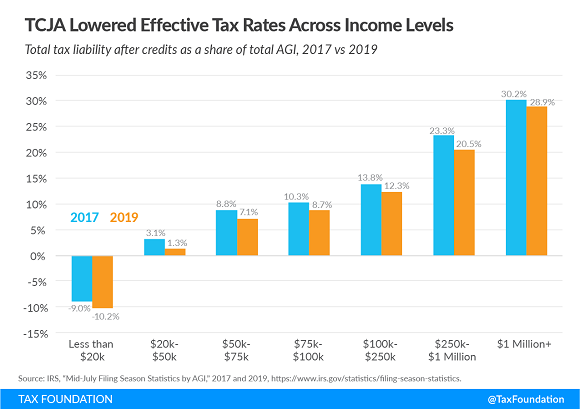

A Preliminary Look at 2019 Tax Data for Individuals - Taylor LaJoie and Erica York, Tax Policy Blog. "Taxpayers making less than $20,000 experienced negative effective tax rates due to refundable tax credits including the Additional Child Tax Credit (ACTC) and Earned Income Tax Credit (EITC). Refundable tax credits allow taxpayers to receive a refund from the government when the amount of credit they are owed surpasses their tax liability."

IRS Will Expand Resolution Options To Help With Tax Bills During Covid - Kelly Phillips Erb, Forbes. "The Internal Revenue Service (IRS) has announced some changes to its collections processes to assist taxpayers who have been impacted by COVID-19. Specifically, the IRS says it is expanding taxpayer options for making payments and alternatives to resolve balances owed."

Related: How to Address COVID-19-Related Tax Collection Issues.

Revenue Officers Continue to Stay Home - Keith Fogg, Procedurally Taxing. "Recent IRS guidance to Revenue Officers, SBSE-05-1020-0084, tells them essentially to stay the course and avoid going into the field unless absolutely necessary."

Tax deduction, credit and income exclusion inflation bumps for 2021 - Kay Bell, Don't Mess With Taxes. "Many of these tax deductions, credits and exclusions also are adjusted each year due to inflation. Following is a look at some of these popular tax breaks and how much they'll be worth in 2021 thanks to the Internal Revenue Service's annual inflation adjustments."

IRS Gives Instructions for Preparation of Forms W-2 for Employers Who Deferred Employee OASDI Under Executive Order - Ed Zollars, Current Federal Tax Developments. "The IRS begins by instructing employers that they should continue to report any wages from which social security was not withheld as social security wages, but not include the deferred social security tax withholdings in the social security withheld box..."

Lesson From The Tax Court: To Get Administrative Grace You Must Follow Administrative Rules - Bryan Camp, TaxProf Blog. "Rev. Proc. 2009-20 gives taxpayers who seek to deduct losses from certain Ponzi-type schemes some very generous safe harbors that relieve them of difficult substantiation requirements. But taxpayers seeking such shelter must navigate the specific procedural rules outlined in the Rev. Proc."

Missed Deadline Costs Illinois County Millions in Cannabis Revenue - Aaron Davis, Tax Notes ($). "Kane County has missed out on a potential $1 million in tax revenue from its 2.5 percent municipal tax on the retail sale of cannabis because 'we did not actually file the ordinance that would allow the Illinois Department of Revenue to collect the tax,' Joe Onzick, executive director of finance for Kane County, said during an October 28 meeting of the city's finance committee."

While Election Day gets all the press, today also marks an invention that brings us much more happiness than we usually get from voting. Today we celebrate National Sandwich Day!

Make a habit of sustained success.