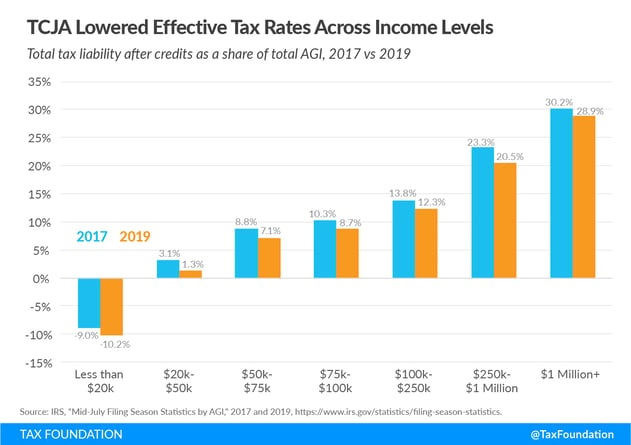

A Preliminary Look at 2019 Tax Data for Individuals – Taylor LaJoie & Erica York, Tax Policy Blog. “The IRS has released tax data covering the first 30 weeks of the tax season, providing a glimpse of how individual taxpayers fared in 2019, the second tax year under the Tax Cuts and Jobs Act (TCJA).”

With stimulus stalled, shortfalls in tax revenues leave states facing layoffs, service cuts – Michael Raga, USA Today. “The 46 states that have reported their tax figures for the period show a combined revenue drop of nearly $30 billion compared with the same stretch last year, according to the Urban Institute, a Washington, D.C. think tank that analyzes tax policy and other issues.”

U.S. States Face Biggest Cash Crisis Since the Great Depression – Heather Gillers and Gunjan Banerji, WSJ ($). “Nationwide, the U.S. state budget shortfall from 2020 through 2022 could amount to about $434 billion, according to data from Moody’s Analytics, the economic analysis arm of Moody’s Corp. The estimates assume no additional fiscal stimulus from Washington, further coronavirus-fueled restrictions on business and travel, and extra costs for Medicaid amid high unemployment.”

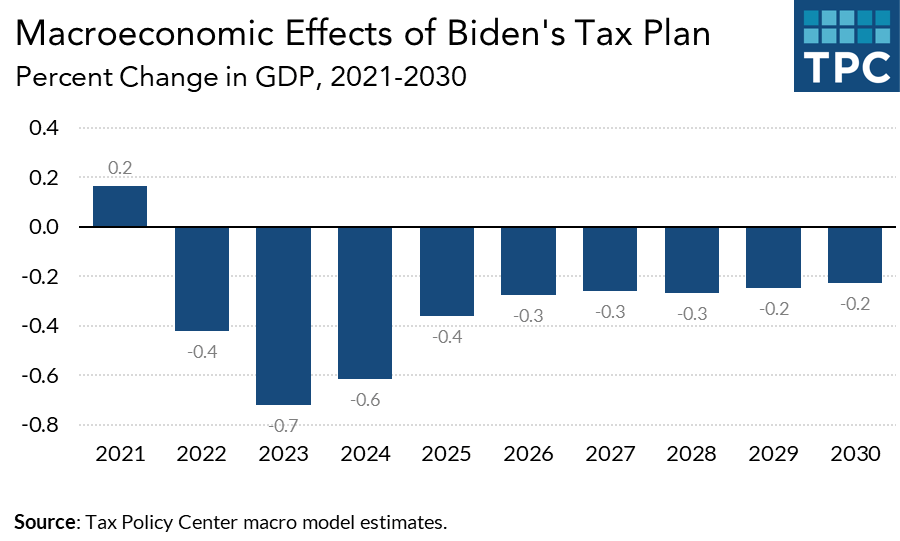

Biden’s Proposed Tax Hikes Would Do Little to Slow The Economy – Benjamin R. Page, TaxVox.

“Former Vice President Joe Biden’s tax proposals would have only modest effects on the economy, according to a new report by the Tax Policy Center (TPC). His proposed tax agenda would boost output by 0.2 percent in 2021, but the net tax increases would reduce it for most of the next two decades, including by 0.2 percent in 2030. By 2040, the tax proposals would increase output by 0.1 percent, and the positive effect would grow larger in later years. Those economic effects would reduce the revenue gain from the proposals modestly over each of the next two decades.”

Tax Court Stops Accepting Hand-Delivered Documents – Nathan Richman, TaxNotes($). “In an October 29 announcement, the Tax Court said that as of October 30, it “will be suspending its in-person acceptance of hand-delivered documents.” The court didn’t predict when it might resume accepting hand-delivered documents.”

Proposed Regs Allow Unit Exclusion in Housing Credit Test – Frederic Lee, Tax Notes($). “The IRS and Treasury have released proposed regulations for the low-income housing tax credit’s average income test — which went into effect in 2018 — that allow certain units to be “removed” from the applicability test.”

Green-Energy Companies Hope for Renewal of Tax Credit, National Plan After Election – Kristin Broughton, WSJ($). “Finance chiefs in the clean-energy sector will face different realities depending on who wins the U.S. presidential election, but are eyeing the possibility of an economic boost under a Democratic victory.”

Costco drops Chaokoh coconut milk over allegations of forced monkey labor – USA Today. “Costco Wholesale Club is the latest retailer to say it won't stock coconut milk that used monkeys to pick coconuts, PETA said.”

Make a habit of sustained success.