Webinar! Adam Sweet and I present the first session of Eide Bailly's 2020 virtual tax update this afternoon. Register now!

Grassley says COVID-19 financial relief package will come sooner if Trump wins - James Lynch, thegazette.com:

“I think if Trump wins, Americans are going to get COVID-19 relief sooner because it’ll come before the end of this Congress,” he told reporters Wednesday.

If Democrats win control of the Senate, the Finance Committee chairman expects pandemic relief might not come until after Jan. 3, when a new Congress convenes.

2020 Third Quarter Published Expatriates – 2020 Is Already the Highest Year Ever - International Tax Blog. "The number of published expatriates for the quarter was 732. The total number of names published during the 3 quarters so far this year equals 6,047. Even without including the fourth quarter, 2020 is already a record year for names published. "

U.S. Citizens and permanent residents working abroad, or with offshore financial interests, face complex reporting requirements with big fines for foot-fault noncompliance.

Surprise: Biden and Trump Both Back A Modest Middle-Income Tax Cut - Howard Gleckman, TaxVox. "At first glance, the tax agendas of presidential candidates Donald Trump and Joe Biden could not be more different. Biden has offered a detailed tax plan. If Trump has a second-term tax strategy, he has kept it mostly under wraps. Biden wants to raise taxes on high-income individuals and corporations, while Trump appears to want to cut them. But in one key respect, their plans appear surprisingly similar: When it comes to middle-income households, each is proposing a modest tax cut—though with quite different timing."

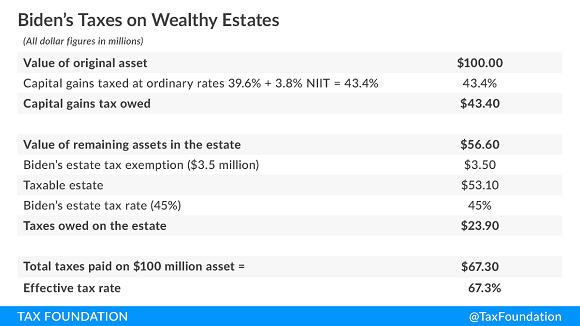

Joe Biden’s 67 Percent Tax on Wealth - Scott Hodge, Tax Foundation. "By historical standards, Biden’s plan to tax unrealized gains at death and levy the estate tax at the same time is quite unique."

It's a long way from a proposal to tax law changes, even if Mr. Biden wins the election and enters office with a Congress inclined to support him. Even so, taxpayers will be watching the election results with an eye towards possible changes in their financial and estate plans.

The Tax Policies Behind the 2020 Presidential Candidates - Tax Notes Opinions (Video). "Robert Goulder, contributing editor for Tax Notes International, Martin Sullivan, chief economist and contributing editor for Tax Notes Federal, and Joseph Thorndike, director of the Tax History Project and contributing editor for Tax Notes Federal, delve into the details of the presidential candidates’ tax proposals. In their discussion, they address the connection between the pandemic stimulus package and tax reform, the rapid evolution of the payroll tax system, and Biden’s proposal for a new capital gains rate."

What Embedded Leases Mean in the New Lease Standard - Matthew Neir, Eide Bailly. "Identifying these contracts starts by reviewing expense details for recurring payments—not only the lease or rent expenses, but all the expense accounts."

Conformity Issues Cause Complications With 163(j) Limitation - Andrea Muse, Tax Notes ($). "...there may also be mismatches between a taxpayer’s ATI at the federal level and ATI at the state level because of the differences in filing methods and because states may require additional adjustments when computing state taxable income."

IRS Letter to Congressional Office Indicates that $10,000 Cap Applies to Deduction of Real Estate Taxes on Real Estate Cooperative Unit Under §216 - Ed Zollars, Current Federal Tax Developments.

Standard & itemized tax deductions for the 2021 tax year - Kay Bell, don't Mess With Taxes. "Tax year in and tax year out, most folks claim the standard deduction instead of itemizing. The option has always been appealing because it's easy. There are no receipts to save. Even better, the Internal Revenue Service provides the standard amount you can claim, based on your filing status, right there on the Form 1040."

States Will Look to Increase Taxes to Recover From Pandemic - Carolina Vargas, Tax Notes. "States will likely increase taxes and cut budget spending to recuperate from the economic impact of the COVID-19 pandemic but are not likely to cut healthcare or education spending, according to tax practitioners."

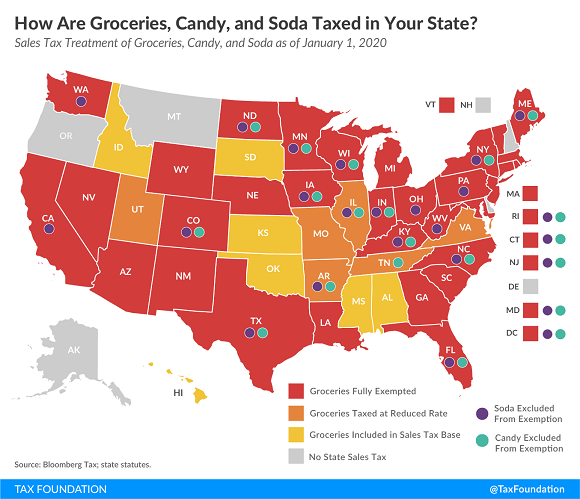

Tax Treatment of Groceries, Candy, and Soda Can Get Tricky - Janelle Cammenga, Tax Policy Blog. "Forty-five states and the District of Columbia levy a state sales tax. Of those, 32 states and the District of Columbia exempt groceries from the sales tax base. Twenty-four states and D.C. treat either candy or soda differently than groceries."

Colorado Man Sentenced to Prison for Biodiesel Tax Credit Fraud - US Department of Justice (defendant name omitted):

According to court documents and statements made in court, from 2010 to 2013, Defendant and his coconspirators defrauded the United States of $7.2 million by filing false claims with the IRS for renewable fuel tax credits. Defendant and his coconspirators formed a company, Shintan Inc. (Shintan), that purported to be in the business of producing renewable fuels. Defendant and his coconspirators then submitted at least 22 claims to the IRS which falsely stated that Shintan had produced over seven million gallons of renewable fuel that qualified Shintan to receive refundable tax credits. Defendant signed a number of false documents in support of these claims, even though he had no knowledge of Shintan ever producing any biodiesel or biodiesel mixtures.

For his role in the scheme, Defendant received nearly $600,000 of the fraud proceeds, which he did not report on his individual tax returns.

15 Month time-out.

Today in History: "The first-ever computer-to-computer link was established on ARPANET (Advanced Research Projects Agency Network), the precursor to the Internet, on October 29, 1969." No word whether a cat picture was involved.

Today is National Oatmeal Day. Celebrate responsibly.

Make a habit of sustained success.