Big Day Tomorrow. The extension period for extended 2019 1040s and 1120 corporate returns ends tomorrow. If you have been sitting on e-file authorizations, get them to your preparer today. If you are mailing, don't wait until tomorrow, and be sure to document timely filing via certified mail or using an authorized private delivery service.

If you are "lucky" enough to live in one of the Iowa counties affected by the August 10 windstorms, in an area affected by recent California or Oregon wildfires, hurricanes Laura or Sally, or tropical storm Isaias, you have some additional time to file your federal returns. Iowa's Department of Revenue has declined to respect the federal derecho extensions, so Iowa individual and corporation returns remain due October 31.

McConnell to force vote on 'targeted' coronavirus relief bill next week - Jordain Carney, The Hill:

“When the full Senate returns on October 19th, our first order of business will be voting again on targeted relief for American workers, including new funding for the PPP," McConnell said in a statement, referring to the Paycheck Protection Program.

McConnell, during a stop in Kentucky on Tuesday, said the bill would be "highly targeted" and authorize around $500 billion. The bill, he noted, would include money for schools, hospitals and protections from coronavirus-related lawsuits.

As both houses need to agree on a package, it's a bit early to get excited about this development.

Practitioners Rejoice at Subtle IRS Change on 199A Calculation - Eric Yauch ($), Tax Notes. "New instructions from the IRS on how to calculate the passthrough deduction indicate that charitable contributions will no longer affect the calculation of the tax benefit aimed at helping small business owners."

2020 Draft Instructions Remove Reference to Reducing QBI by Charitable Contributions - Ed Zollars, Current Federal Tax Developments. "As the Tax Notes Today Federal article notes in quotes from a number of tax professionals, many had been surprised when the reference to charitable contributions being used in computing QBI cropped up in various 2019 IRS instructions and had questioned whether, in fact, the implied position of the IRS could be supported under the law."

Where Trump and Biden Stand on Tax Policy - Richard Rubin, Wall Street Journal ($). "Because tax policy is so polarizing, neither candidate is likely to accomplish much without full control of Congress. A Republican sweep would mean more tax cuts, while a Democratic sweep would bring increases. Anything in between results in a stalemate."

Post-Election Tax Reform Possibilities - Benjamin Willis and Victor Fleischer, Tax Notes Opinions. "As [the corporate] rate goes up, you have to worry about companies trying to invert. If you think back to the corporate tax rate at 35 percent, you [had] a really strong incentive to try to do an inversion or to incorporate your company offshore. There is less concern about that at 21 percent. Twenty-eight percent is somewhere in the middle and . . . a moderate approach is appropriate for trying to make sure that companies that are headquartered in the U.S. continue to find the U.S. a competitive tax environment."

International Tax Competitiveness Index 2020 - Daniel Bunn and Elke Asen, Tax Policy Blog:

A competitive tax code is one that keeps marginal tax rates low. In today’s globalized world, capital is highly mobile. Businesses can choose to invest in any number of countries throughout the world to find the highest rate of return. This means that businesses will look for countries with lower tax rates on investment to maximize their after-tax rate of return. If a country’s tax rate is too high, it will drive investment elsewhere, leading to slower economic growth. In addition, high marginal tax rates can lead to tax avoidance.

According to research from the OECD, corporate taxes are most harmful for economic growth, with personal income taxes and consumption taxes being less harmful. Taxes on immovable property have the smallest impact on growth.

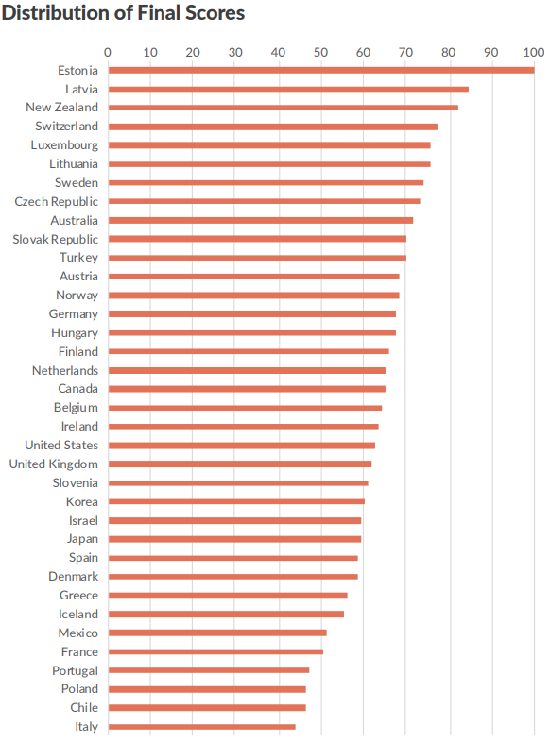

Of the 36 OECD countries rated, Estonia retains the top spot. Italy is at the bottom. The U.S. is in the bottom half, at 21st place. The entire list:

Related: Eide Bailly Outbound International Tax Planning.

Haircut Tax Write-Offs And Other Strange Ones - Robert W. Wood, Forbes. "During COVID-time, any haircut might seem a luxury. But if it is true about the $70,000 worth of haircuts, it might cause some of us to think, hey, how about my usual haircut, if I ever go back to my usual haircut?"

COVID-19 Is Changing The Labor Market. Tax Policy Must Change Along With It. - Nikhita Airi, TaxVox. "The tax code’s biggest support for low-income households is tied to work. The earned income tax credit (EITC) supplements labor earnings up to a maximum amount, when it begins to phase out. But it is designed to primarily to help families with children."

Social Security recipients to get bigger benefits in 2021, but some retiree money could be taxable - Kay Bell, Don't Mess With Taxes. "If you do get income in addition to Uncle Sam's retirement benefits, then you'll likely owe tax on at least part of your Social Security. The amount is based on how much other money you receive in addition to your government amounts."

Latest Update on Providing Stimulus Payments to Incarcerated Individuals - Keith Fogg, Procedurally Taxing. Dear reader, I hope this one is only of academic interest to you.

Tax Court Will Go Dark For December - Peter Reilly, Forbes:

What is extraordinary is that the Tax Court’s existing system will shut down before Thanksgiving and DAWSON will not come on till after Christmas. Nothing new electronic goes in after 5:00PM on November 20th and it is expected that DAWSON will be up on December 28th. But there is more.

Here is the most extraordinary thing. During the hiatus the Tax Court will issue no orders or opinions.

The holiday season is ruined.

Time Flies. A mere 954 years ago today, a guy from France named William led an army that defeated one led by Harold Godwinson in Hastings, East Sussex. As a result, we now speak a strange mixture of Old English, Norman French, and Old Norse. But at least we don't have to worry whether our nouns are boys or girls.

Make a habit of sustained success.