Key Takeaways

- NJ takes on NY remote worker tax.

- Taxes and the NFL draft.

- Iowa goes with flat tax.

- Kansas tax cut veto override.

- Maine minor league tax credit.

- NE ends STO program.

- PA v. Perrier.

- Tax Policy Corner

- When things between NY and NJ got serious.

Welcome to this edition of State Tax News & Views. Remember Eide Bailly for your State & Local Tax Needs.

New Jersey is motivating telecommuters to appeal their New York tax bills. Connecticut may be next - Susan Haigh, Associated Press via The Hill:

The Garden State’s bounty — a rebate worth roughly half a person’s refund of income taxes they paid to New York for the 2020-2023 period — has been claimed so far by one winning litigant since the state made the offer in July, according to the state’s Division of Taxation. That taxpayer received a $7,797.02 refund for their efforts. Officials hope that person’s windfall will encourage others to follow suit.

The remote worker tax is a result of New York's "convenience of the employer" rule, a poorly-named policy that often treats remote employees who work both within and outside of New York as always being in New York. The New York regulation provides that "...any allowance claimed for days worked outside New York State must be based upon the performance of services which of necessity, as distinguished from convenience, obligate the employee to out-of state duties in the service of his employer."

John Gupta, head of Eide Bailly's State & Local Tax team, comments:

It is unlikely that these neighboring states have legal standing to directly sue New York over its convenience rule. So, they are incentivizing its residents to do so with tax credits conditioned on successful challenges to the convenience rule. The problem is that the adverse impact of the convenience rule to any one individual taxpayer generally won’t justify the cost and effort for them to carry the litigation. Its highly questionable whether these credits are enough to change that dynamic.

It takes a highly-motivated or very high-income remote worker to go to battle against New York.

State Income Taxes and the 2024 NFL Draft Class - Jared Walczak, Tax Foundation. "The basic rule of income tax liability is that you owe income taxes where you live and where you work, but with a credit to avoid double taxation. With the rise of remote work, a growing number of people work in states other than where their employer is located, in which case they typically don’t owe income taxes in their employer’s state. (A few states, like New York, have a double-taxing policy called the convenience rule that can be a nightmare for certain taxpayers in this situation. But that’s the exception, not the rule.) For an NFL player, of course, there’s little question that they earn most of their income in the state that hosts the team itself. If they happen to live elsewhere, they would owe taxes on all their income in their home state, then on most of their salary in the state where the stadium is located, and on some of their income in other states in which they played games, and they would take a credit against their home state’s tax liability for all these out-of-state payments. But for simplicity’s sake, we’ve assumed in our calculations that players live in their team’s state."

State-By-State Roundup

Alaska

Alaska High Court Block City From Collecting Back Tax - Michael Nunes, Law360 Tax Authority ($). "An Alaskan city that successfully challenged the state's oil and gas property tax system can't assess taxes on the property from the start of the appeal nearly 20 years ago, the state's high court ruled"

California

California Panel Advances Ban on Retailer Tax Deals With Cities - Laura Mahoney, Bloomberg ($):

The bill (S.B. 1494), from committee Chair Sen. Steve Glazer (D), won 5-0 committee approval. It moves next to the Senate floor, where it faces opposition from business and local government groups, including the California Taxpayers Association, California Chamber of Commerce, California Retailers Association, and League of California Cities. The measure was reported out of another committee last week.

California Digital Ad Tax Bill Advances in Assembly - Paul Jones, Tax Notes ($). "A.B. 2829, which would levy a 5 percent tax on digital advertising service providers’ gross revenue from digital advertising in California, was approved by the Assembly Committee on Privacy and Consumer Protection on a 6–3 vote. The tax revenue would fund youth mental health services."

Colorado

Colo. To Forgive Underpayments Caused By State's Bad Info - Zak Kostro, Law360 Tax Authority ($) "Colorado will hold vendors harmless for underpayments of sales or use tax caused by errors in a state Department of Revenue information system database under a bill signed by Democratic Gov. Jared Polis."

Iowa

Iowa Lawmakers Approve Accelerate Flat Income Tax - Emily Hollingsworth, Tax Notes ($):

S.F. 2442 cleared the Senate on a 39-7 vote and the House on a 68-24 vote on April 19, one day before the session adjourned

In a separate measures, the General Assembly approved a restoration of the exclusions for capital gain income on the sale of breeding livestock (HF 2649), retroactive to 2023. An extension of the retired farmer lease income exclusion to pass-through income (HF 2666) and a proposal to revive the Iowa Film Tax Credit (HF 2662) both cleared the Iowa House, but died without coming to a vote in the Iowa Senate.

Iowa lowers tax rates for captive premiums - Diana Bui, Captive Insurance Times:

Under the act, premiums written above US $60 million will be taxed at a rate of 0.02 per cent, instead of the five per cent rate that applied previously.

Kansas

Kansas Governor Vetoes Another GOP Tax Cut Bill, Offers New One - Angélica Serrano-Román, Bloomberg ($):

The measure the Democratic governor rejected (HB 2036)—her third veto of a tax cut bill from the GOP Legislature—would have lowered the top personal income tax rate from 5.7% to 5.55% for incomes starting at $23,001, while also reducing the number of tax brackets from three to two. Earlier vetoed measures would have moved directly to a single, flat-rate tax.

Kansas lawmakers override governor’s veto of tax cut plan - Shawn Loging, KWCH.com:

The vote was 104-15 in favor of an override.

Kentucky

Ky. To Exempt Some EV Charging Stations From Excise Tax - Zak Kostro, Law360 Tax Authority ($) "Kentucky will exempt electric vehicle charging stations with a charging capacity of less than 20 kilowatts from the state's excise tax on electric vehicle power under a bill signed by the governor. H.B. 122, which Democratic Gov. Andy Beshear signed April 17, specifies that an "electric vehicle power dealer," for purposes of the excise tax, means a person who owns or leases an electric vehicle station with a charging capacity of 20 kilowatts or more, according to the bill's text."

Maine

Maine Enacts Tax Credit to Keep Portland Baseball Team - Matthew Pertz, Tax Notes ($). "L.D. 2258 — signed by Gov. Janet Mills (D) on April 22 — passed the House 92 to 52 on April 17 and cleared the Senate 20 to 13 the next day. The bill provides a refundable income tax credit equal to 1.33 percent of a certified minor league baseball team’s qualified investment in a stadium for 14 consecutive years, with a maximum credit of $133,000 annually. The state's only minor league team is the Portland Sea Dogs."

Nebraska

Neb. To End Individual, Corp. Tax Break For Scholarship Gifts - Zak Kostro, Law360 Tax Authority ($):

Instead of a tax credit, L.B. 1402 appropriates $10 million for fiscal year 2024-2025 and every year thereafter from the state's general fund to the state treasurer to provide scholarships to eligible students at qualified schools, according to the fiscal note and bill text.

Nebraska Property Tax Relief Bill Fails to Pass; Special Session Likely - Emily Hollingsworth, Tax Notes ($). "A controversial provision in the bill is a 7.5 percent tax on advertising services — including digital advertising — in the state by businesses with gross advertising revenue of at least $1 billion."

New York

NY Lawmakers Approve Overhauling Cannabis Tax System - Paul Williams, Law360 Tax Authority ($)."New York is slated to scrap its potency-based tax system for adult-use cannabis and replace it with a more streamlined wholesale tax structure in June under a budget-related bill approved by state lawmakers."

North Carolina

North Carolina Governor Would End Further Corporate Tax Cuts - Angélica Serrano-Román, Bloomberg($):

In his final budget proposal as governor, the term-limited Democrat recommended maintaining the corporate rate at 2.5%, instead of having it phase out by 2030 as directed by 2021 legislation. The law currently schedules reductions to 2.25% in 2025, 2% in 2026 and 2027, and 1% in 2028 and 2029.

Oklahoma

Okla. To Expand Property, Income Tax Break For Airports - Zak Kostro, Law360 Tax Authority ($)."Oklahoma will expand a property and income tax exemption for municipally owned airports in the state under a bill signed by the governor. H.B. 3672, which Republican Gov. Kevin Stitt signed Thursday, expands the exemption to include air navigation property and "vertiports," defined as land used for the takeoff and landing of aircraft with "the ability to takeoff and land vertically," according to the legislation and a summary of the measure"

Okla. House OKs Expanding Industrial Development Tax Break - Jaqueline McCool, Law360 Tax Authority ($) "Oklahoma would expand a tax credit for qualified economic development expenditures in industrial parks, removing a limit on the credit, under a bill passed in the House and headed to the governor."

Pennsylvania

Oh, La La! Pennsylvania Court Rules Perrier Is A Soft Drink—And Taxable - Kelly Phillips Erb, Forbes ($). "The Commonwealth argued that Perrier is not exempt from tax as water, but is carbonated water. That means, they said, that it falls squarely within the definition of soft drink and is subject to sales tax."

Tennessee

Tennessee House, Senate reach deal on franchise tax bill — including public disclosures - Vivian Jones, Nashville Nennessean:

Lee’s franchise tax package is largest new spending item this year. The plan would eliminate the franchise tax property tax calculation (expected to cost the state $400 million in revenue beginning this year) and offer up to $1.5 billion in refunds for as many as 100,000 businesses that paid taxes based on the property measure over the last three years. Administration officials have said the refunds are indispensable to avoid lawsuits and court-ordered penalties.

Tax Policy Corner

Top Tax Rates Are Already on Wrong Side of Laffer Curve in at Least Ten States - Adam Michel, Liberty Taxed:

...

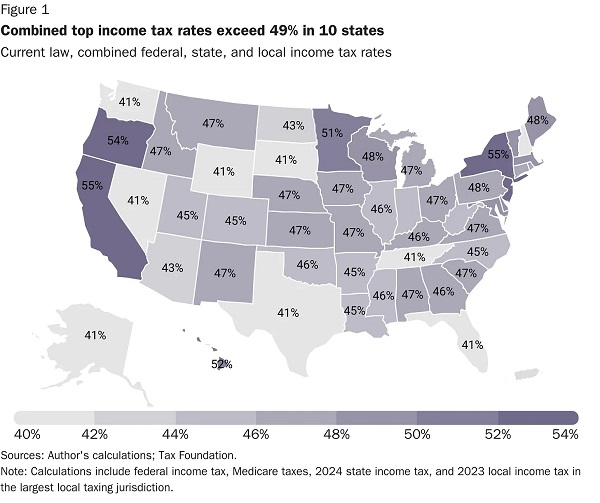

Under current law, combined top income tax rates exceed 49 percent in 10 states.

Tax History Corner

The fight over the "convenience of the employer" rule follows a rich tradition of tension between New York and New Jersey that goes back to before they were even states. Wikipedia reports on the New York-New Jersey Line War:

...

The last fight broke out in 1765, when the Jerseyans attempted to capture the leaders of the New York faction. Because the fight took place on the Sabbath, neither side used weapons. The New York leaders were captured and kept briefly in the Sussex County jail.

A Royal Commission sorted things out, leading to a settlement ratified by King George III on September 1, 1773.

Maybe wouldn't be practical, but state taxes would be more fun if state legislatures made unarmed raids on each other.

We're Here to Help