The Case of Dad's Missing IRA Basis. A California oncology surgeon inherited an IRA from his father. Being a self-sufficient sort (he argued his own case in Tax Court), he went to the IRS website to figure out how to report the IRA payments as he withdrew them. Tax Court Judge Marvel sets the stage:

At trial petitioner did not contest that he received retirement distributions in the amounts shown on the information returns. Rather, his position is that a portion of each distribution is not taxable because it represents his late father's original investment in the account. At trial petitioner stated that he had contacted the financial institutions that had held the IRA — TD Ameritrade and Fidelity — seeking documentation to determine the portion that represented his late father's original investment.Traditional (non-Roth) IRAs come in two flavors: Deductible and Non-Deductible. Taxpayers can deduct their allowable IRA contributions either if they have no employer retirement plan or if their income is below certain limits. If the taxpayer cannot deduct the contribution, it creates basis in the IRA that is recovered tax-free as the taxpayer withdraws funds from the IRA. Some background here.

Taxpayers track their IRA basis using Form 8606. Unfortunately, some taxpayers don't bother with the form, or with telling their preparers about their IRA contributions. They think it is pointless paperwork because there is no deduction. That's a mistake, as this case shows. Judge Marvel, again:

Unfortunately, neither institution had the records he sought. At trial he conceded that he could not substantiate that any portion of the distributions represented a return of his late father's original investment. We find credible petitioner's statement at trial that he attempted to find records that could substantiate his position, and we sympathize with him for the dilemma in which he found himself when he inherited his late father's IRA. But petitioner bears the burden of proving respondent's determinations to be incorrect, and he has not. Therefore, we must sustain respondent's determinations.It would have saved our surgeon a lot of time and hassle -- not to mention almost $20,000 in penalties -- if copies of his father's tax returns with attached Forms 8606 were available.

The Moral? If you are making traditional IRA contributions, make sure your tax return includes Form 8606. Leaving it out can become painfully expensive.

Cite: T.C. Memo 2020-23

The White House Budget Highlights the Need to Extend Pro-Growth TCJA Business Tax Provisions - Garrett Watson, Tax Policy Blog. "Using the Tax Foundation’s General Equilibrium Model, we estimate that economic output would be 1.17 percent larger in the long run if 100 percent bonus depreciation were made permanent and the planned amortization of R&D expenses were canceled."

It would be nice if the tax law just stood still a little while.

Thieves Targeted Students & The Dead In Stolen Identity And Tax Refund Fraud Scheme - Kelly Phillips Erb, Forbes.

The Importance of Difficult Conversations in Fraud Prevention - Doug Cash, Eide Bailly. "For accounting staff, difficult conversations normally revolve around questionable activity in the book keeping or bank accounts. When it comes to protecting your company’s finances, these financial conversations may revolve around the conduct of a “trusted” long-term family member or employee. The stress level and uncomfortableness of this difficult conversation just went up another notch."

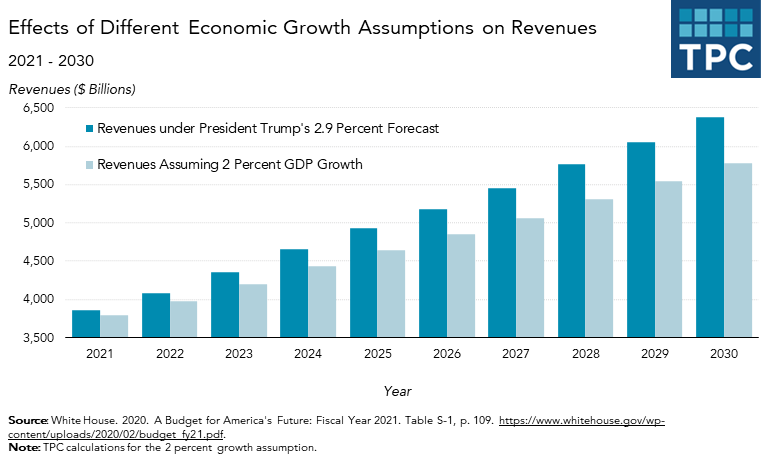

Trump’s 10 Year Revenue Estimates Would Fall By At Least $3 Trillion With Realistic Economic Assumptions - Howard Gleckman, TaxVox."Using CBO’s more conservative forecast of about 1.7 percent real annual growth, revenues would fall nearly $770 billion short of Trump’s projections in 2030 alone, and $3.9 trillion lower over 10 years."

Facts and Figures 2020: How Does Your State Compare? - Janelle Cammenga, Tax Policy Blog. "Tax Freedom Day" by state. Iowa is April 15. The earliest is Alaska's March 25, and the latest is May 3 for New York and D.C.

Did you know? You can track your refund at the IRS "Where's My Refund" site. Many states offer similar features.

Make a habit of sustained success.