This is a roundup of tax news and opinion. Opinions found at the link are those of the authors of the linked item, not of your bloggers or of Eide Bailly.

Esports join NFL, other traditional games as jock tax target, Kay Bell. “Who's really surprised?”

Does the Penalty Relief for a “Small Partnership” Still Apply? - Roger McEowen:

Typically, the small partnership exception is limited in usefulness to those situations where the partners are unaware of the partnership return filing requirement or are unaware that they have a partnership for tax purposes, and the IRS asserts the penalty for failing to file a partnership return. In those situations, the partnership can use the exception to show reasonable cause for the failure to file a partnership return. But, even if the exception is deemed to apply, the IRS can require that the individual partners prove that they have properly reported all tax items on their individual returns.

Lesson From The Tax Court: Employee Cannot Deduct Expense That Could Have Been Reimbursed - Bryan Camp, TaxProf Blog. “Whether you go with Judge Kerrigan's approach or mine, they both lead to the same bottom line: Take the reimbursement.”

2020 Due Dates For Tax Forms Like Your W-2 & 1099 - And What To Do If They’re Missing. Kelly Phillips Erb, Forbes. “One final piece of advice: do not file your tax returns until you've received your tax forms. I know it's tempting. I know you think you know what's on those forms, but what if you're wrong?”

Tax Court Demolishes Deconstruction Deduction. Peter Reilly, Forbes. “As it happens, though, the IRS has won in court only against taxpayers who did not execute well.”

Pursuing Donees for Unpaid Gift Taxes - Brian Krastev, Procedurally Taxing. “Unpaid gift taxes bear many similar traits to unpaid estate taxes. In both cases, when the donor or executor is unable to pay the tax, the donees or heirs are personally liable to the extent of the value of the property they were gifted or bequeathed.”

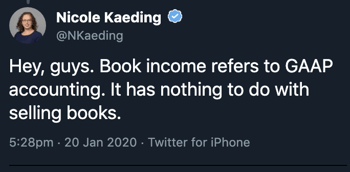

Wisdom from #taxtwitter:

We're Here to Help